Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

NRx Pharmaceuticals NRXP is expected to report its fourth-quarter 2024 results soon. The Zacks Consensus Estimate for NRXP’s loss per share is pinned at 20 cents. In the absence of a marketed product, the company is not likely to have generated revenues in the to-be-reported quarter.

See the Zacks Earnings Calendar to stay ahead of market-making news.

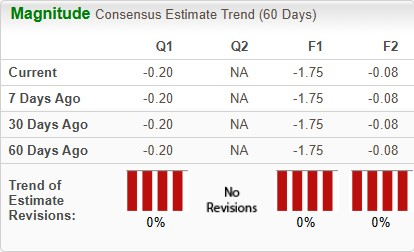

In the past 60 days, the Zacks Consensus Estimate for NRx Pharmaceuticals’ 2024 loss per share has remained constant at $1.75. During the same time frame, the company’s 2025 loss per share forecast has remained constant at 8 cents.

Image Source: Zacks Investment Research

NRx Pharmaceuticals’ performance has been encouraging over the trailing three quarters, with earnings beating estimates in each of the quarters. On average, NRXP registered an earnings surprise of 39.15% in the last three quarters. In the last reported quarter, the company reported an earnings surprise of 81.48%.

Image Source: Zacks Investment Research

Our proven model does not conclusively predict an earnings beat for NRx Pharmaceuticals this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

NRx Pharmaceuticals has an Earnings ESP of -0.20% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the absence of a marketed product in its commercial portfolio, the company is likely to provide a thorough update on its novel pipeline candidates, which are being developed for treating central nervous system disorders, specifically suicidal bipolar depression, chronic pain, post-traumatic stress disorder (“PTSD”) and schizophrenia.

The company has two lead drug candidates – NRX-101, an oral fixed-dose combination of D-cycloserine and lurasidone, and NRX-100, a preservative-free formulation of ketamine for intravenous (IV) infusion.

NRX-101 is being developed in a phase IIb/III study for the treatment of suicidal bipolar depression, chronic pain and PTSD, while IV ketamine (NRX-100) is being developed for the treatment of suicidal depression.

In December 2024, NRx Pharmaceuticals submitted the initial section of the new drug application (“NDA”) to the FDA for NRX-100 (IV ketamine) for the treatment of suicidal depression, which is considered a national crisis.

While assembly of the clinical data is being completed, the FDA has asked NRXP to submit the 1800-page manufacturing section (Module 3) of the NDA to enable immediate review before submitting the final efficacy data and other sections, which is expected in the first quarter of 2025.

If approved, NRX-100 would be the first medicine to treat acute suicidality in the world.

The company is expected to have provided updates regarding the clinical-stage pipeline programs on its fourth-quarter earnings call.

Research and development expenses are expected to have decreased in the to-be-reported quarter, due to the conclusion of the phase IIb/III study on NRX-101.

The stock has rallied 86.1% in the past three months against the industry’s 5.4% decline. NRXP has also outperformed the S&P 500 and the sector in the same period, as seen in the chart below. NRx Pharmaceuticals is currently trading above the 200-day moving average and below the 50-day moving average.

Image Source: Zacks Investment Research

NRx Pharmaceuticals is still a clinical-stage company engaged in drug discovery and development, which has historically been complex, costly and prone to failure. Traditional biotech companies rely on a “trial-and-error” approach, leading to significant cash burn during early research and development. The high failure rates and funding challenges often result in financial instability, hindering progress in the sector.

The successful development and approval of its candidates would significantly enhance shareholder value in the long run.

NRx Pharmaceuticals’ wholly owned subsidiary, HOPE Therapeutics, aims to offer a network of precision psychiatry clinics to study precision psychiatric treatment. Per management, IV ketamine has now become a standard of care for the acute treatment of suicidal depression in the absence of an FDA-labeled product.

Competition in the target market remains a worry for NRx Pharmaceuticals as several companies are also engaged in developing treatments for schizophrenia and bipolar I disorder.

Though J&J’s JNJ Spravato (esketamine) is approved by the FDA for treatment-resistant depression, it has not demonstrated a benefit on suicidality and is not approved for use in patients with bipolar depression.

Meanwhile, Alkermes’ ALKS Lybalvi (olanzapine and samidorphan) is approved by the FDA for the treatment of adults with schizophrenia and adults who have bipolar I disorder. It is approved as a maintenance monotherapy or for the acute treatment of manic or mixed episodes, as monotherapy or an adjunct to lithium or valproate.

With clinical studies progressing well, existing investors should hold NRXP stock for long-term gains, no matter how fourth-quarter results pan out.

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

NRx Pharmaceuticals, Inc. (NRXP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.