Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

With the Nasdaq dwelling in correction territory, AppFolio APPF appears to be a tech stock that investors may want to avoid at the moment.

As a cloud-based software provider for the real estate industry, AppFolio’s exposure to higher tariffs might be limited but increased competition from a number of private and public competitors’ have contributed to investor caution along with fluctuations in demand for property management solutions.

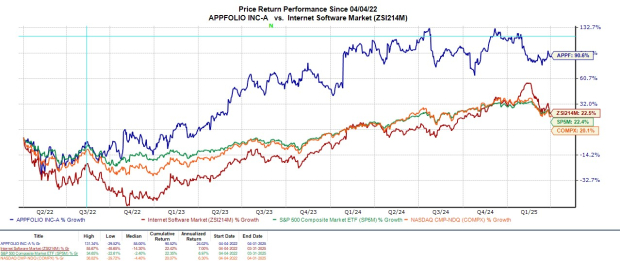

Now may be an ideal time to take profits in AppFolio’s stock which is down 10% in 2025 but is still sitting on +90% gains over the last three years to top the +20% gains of the broader indexes and its Zacks Internet-Software Market.

While AppFolio is still expected to post 20% EPS growth in fiscal 2025 and FY26, it’s noteworthy that earnings estimate revisions are down in the last 60 days. This trend has become evident for its primary competitor CoStar Group CSGP as well.

Pictured below is the Consensus EPS trend for AppFolio with some of its private market competitors being up-and-coming property management software providers such as RealPage and Yardi Systems.

The decline in EPS estimates doesn’t necessarily scream sell but APPF is trading over $220 and at 40.9X forward earnings with investors getting increasingly cautious of the premium they are paying for stocks, even with high-growth tech companies.

In this regard, APPF still trades at a noticeable premium to the benchmark S&P 500’s 21.2X forward earnings multiple and its Zacks Internet-Software Industry average of 26.2X.

Simply put, the hype for AppFolio's stock may wear thin as more property management solution providers enter the market. Keeping this in mind, it would be no surprise if a further drop in APPF is still ahead, especially as the Nasdaq grapples with correction territory.

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

CoStar Group, Inc. (CSGP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.