DKK to PLN Forecast: Danish Krone to Zloty Currency Exchange Rate Prediction

)

The Danish krone's exchange rate forecast has seen increased interest lately as currency traders analyze the potential direction of the DKK to PLN pair. With the krone sensitive to economic and political developments in the EU, technical analysis of the price charts can provide insights into support, resistance, and trend levels. This guide will help you form a clear picture of this currency pair on the market and provide various predictions on the course of the Danish krone to Polish Zloty in the short- and long-term perspective.

Table of Contents

About the Danish Krone / Polish Zloty currency rate forecast

Danish Krone technical analysis

DKK/PLN Price History

Danish Krone to Zloty Forecast for 2025

Danish Krone to Zloty Forecast for 2026

Danish Krone to Zloty Forecast for 2027

Danish Krone to Zloty Forecast for 2028

Danish Krone to Zloty Forecast for 2029

Danish Krone to Zloty Forecast for 2030

What Affects the DKK/PLN Rate?

How to predict the DKK/PLN exchange rate

Conclusion

FAQs

About the Danish Krone / Polish Zloty currency rate forecast

As of April 2025, the Danish Krone (DKK) to Polish Zloty (PLN) exchange rate stands at approximately 0.573 PLN per 1 DKK. This reflects a modest appreciation from the year's low of 0.5550 PLN observed on February 26, 2025.

Looking ahead, financial analysts forecast a neutral to slightly negative trend for the DKK/PLN pair.

| Year |

Maximum Price (zł) |

Minimum Price (zł) |

Average Price (zł) |

| 2025 | 0.574 | 0.562 | 0.5668 |

| 2026 | 0.562 | 0.543 | 0.5517 |

| 2027 | 0.543 | 0.524 | 0.5328 |

| 2028 | 0.524 | 0.505 | 0.5138 |

| 2029 | 0.505 | 0.486 | 0.4947 |

| 2030 | 0.486 | 0.476 | 0.4820 |

Key Takeaways

- The DKK PLN rate is 0.573.

- Throughout 2025, DKK could go slightly lower.

- Due to forex market volatility, experts' opinions on the DKK forecast could vary, yet the general trend is from neutral to negative.

Danish Krone technical analysis

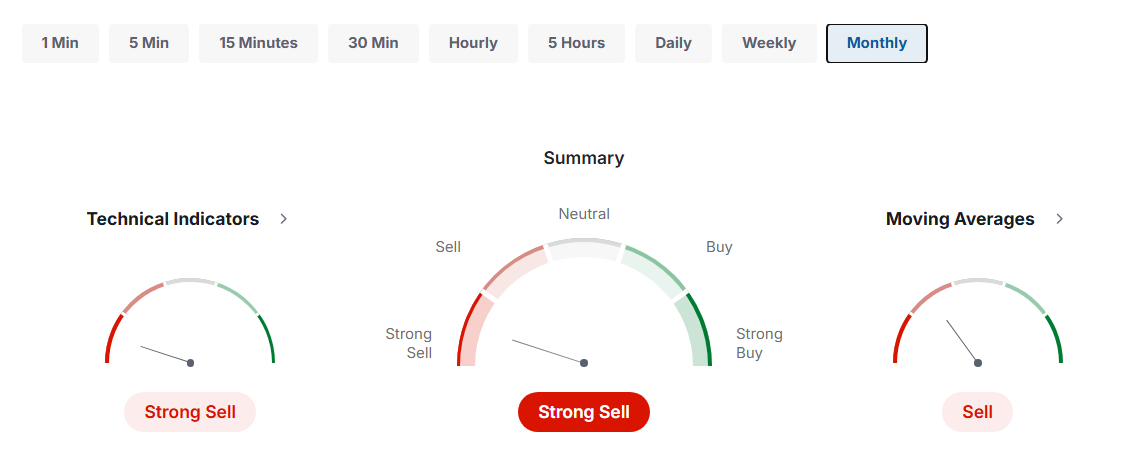

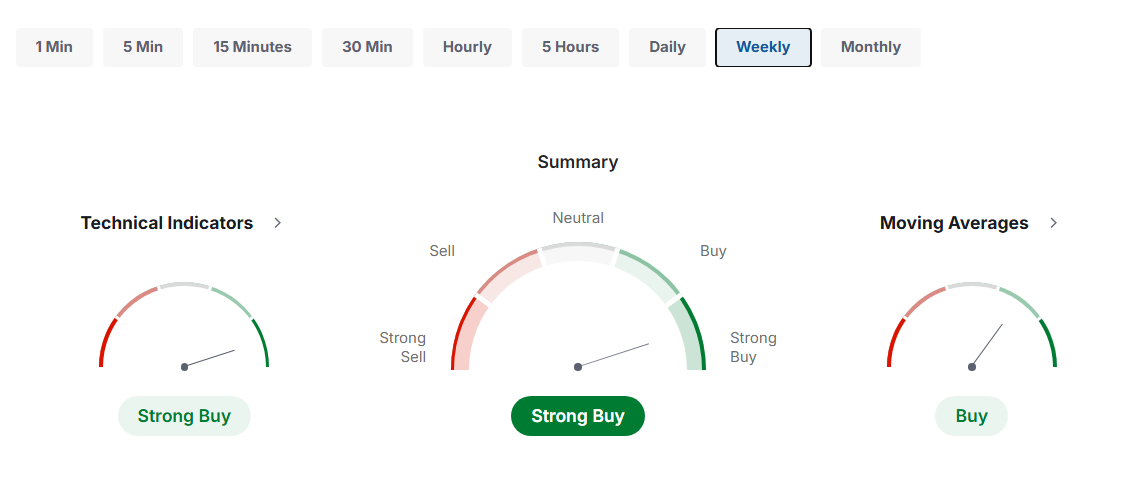

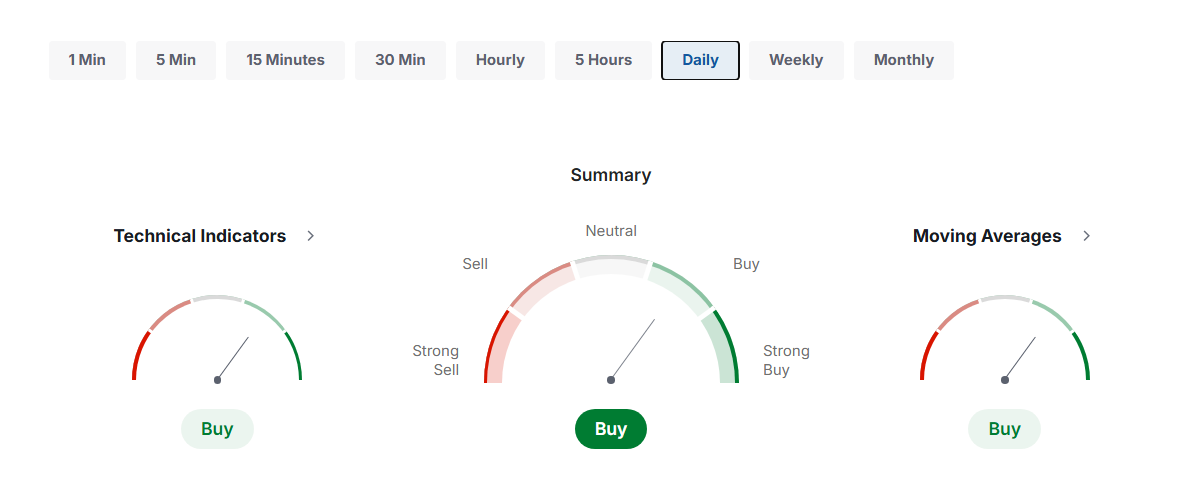

The current technical analysis for the krone to Polish zloty exchange rate shows mixed signals. Monthly charts reveal a strongly bearish sentiment, suggesting downward pressure on the DKK/PLN currency pair. However, weekly charts forecast bullish movements, shifting signals from buy to strong buy. Daily charts also indicate bullish sentiment, with the PLN exchange rate nearing key resistance levels, affecting the current rate forecasts.

DKK/PLN Price History

The price history of the Danish krone to Polish zloty exchange rate indicates a clear downward trend over the two-year period from January 2023 to December 2024. Starting at around 0.6307 PLN per Danish krone, the rate steadily decreased, reaching approximately 0.5731 PLN by the end of 2024.

| Month |

DKK to PLN Rate |

| January 2023 | 0.630752 |

| February 2023 | 0.636919 |

| March 2023 | 0.630077 |

| April 2023 | 0.622851 |

| May 2023 | 0.609606 |

| June 2023 | 0.599068 |

| July 2023 | 0.596520 |

| August 2023 | 0.597830 |

| September 2023 | 0.616209 |

| October 2023 | 0.605350 |

| November 2023 | 0.590637 |

| December 2023 | 0.580853 |

| January 2024 | 0.5803 |

| February 2024 | 0.5784 |

| March 2024 | 0.5745 |

| April 2024 | 0.5806 |

| May 2024 | 0.5723 |

| June 2024 | 0.5776 |

| July 2024 | 0.5748 |

| August 2024 | 0.5734 |

| September 2024 | 0.5743 |

| October 2024 | 0.5835 |

| November 2024 | 0.5760 |

| December 2024 | 0.5731 |

Danish Krone to Zloty Forecast for 2025

The Danish krone exchange rate forecast for 2025 presents a relatively stable outlook, with minor fluctuations in the Danish krone to Polish zloty exchange rate.

| Month |

Min Rate |

Max Rate |

Average Rate |

| June | 0.572 | 0.574 | 0.573 |

| July | 0.565 | 0.573 | 0.569 |

| August | 0.564 | 0.566 | 0.565 |

| September | 0.566 | 0.568 | 0.567 |

| October | 0.565 | 0.568 | 0.5665 |

| November | 0.563 | 0.565 | 0.564 |

| December | 0.562 | 0.564 | 0.563 |

Danish Krone to Zloty Forecast for 2026

According to WalletInvestor, in 2026, the Danish krone to zloty currency pair is predicted to have a consistent trading volume with no significant buy or sell signals. However, the market is expected to show slight negative moves.

| Month |

Min Rate |

Max Rate |

Average Rate |

| January | 0.560 | 0.562 | 0.5610 |

| February | 0.559 | 0.560 | 0.5595 |

| March | 0.556 | 0.559 | 0.5575 |

| April | 0.552 | 0.556 | 0.5540 |

| May | 0.553 | 0.555 | 0.5540 |

| June | 0.553 | 0.555 | 0.5540 |

| July | 0.546 | 0.554 | 0.5500 |

| August | 0.545 | 0.547 | 0.5460 |

| September | 0.547 | 0.549 | 0.5480 |

| October | 0.546 | 0.549 | 0.5475 |

| November | 0.544 | 0.546 | 0.5450 |

| December | 0.543 | 0.545 | 0.5440 |

Danish Krone to Zloty Forecast for 2027

The 2027 DKK to Polish zloty forecast indicates a relatively stable market. The pair will be traded in the range of around 0.524 to 0.541.

| Month |

Min Rate |

Max Rate |

Average Rate |

| January | 0.541 | 0.543 | 0.5420 |

| February | 0.540 | 0.541 | 0.5405 |

| March | 0.537 | 0.540 | 0.5385 |

| April | 0.533 | 0.537 | 0.5350 |

| May | 0.534 | 0.536 | 0.5350 |

| June | 0.534 | 0.536 | 0.5350 |

| July | 0.527 | 0.536 | 0.5315 |

| August | 0.526 | 0.528 | 0.5270 |

| September | 0.528 | 0.530 | 0.5290 |

| October | 0.527 | 0.530 | 0.5285 |

| November | 0.525 | 0.527 | 0.5260 |

| December | 0.524 | 0.526 | 0.5250 |

Danish Krone to Zloty Forecast for 2028

The DKK to PLN forecast for 2028 suggests a stable yet cautiously negative exchange rate trend.

| Month |

Min Rate |

Max Rate |

Average Rate |

| January | 0.522 | 0.524 | 0.5230 |

| February | 0.521 | 0.522 | 0.5215 |

| March | 0.518 | 0.521 | 0.5195 |

| April | 0.514 | 0.518 | 0.5160 |

| May | 0.515 | 0.517 | 0.5160 |

| June | 0.515 | 0.517 | 0.5160 |

| July | 0.5079 | 0.516 | 0.51195 |

| August | 0.5073 | 0.5092 | 0.50825 |

| September | 0.5092 | 0.511 | 0.51010 |

| October | 0.5083 | 0.511 | 0.50965 |

| November | 0.5064 | 0.5083 | 0.50735 |

| December | 0.5050 | 0.5066 | 0.50580 |

Danish Krone to Zloty Forecast for 2029

The DKK to PLN exchange rate in 2029 reflects predominantly bearish sentiment with gradual declines and limited recovery phases.

| Month |

Min Rate |

Max Rate |

Average Rate |

| January | 0.5027 | 0.5050 | 0.5039 |

| February | 0.5015 | 0.5028 | 0.5022 |

| March | 0.4990 | 0.5021 | 0.5006 |

| April | 0.4950 | 0.4990 | 0.4970 |

| May | 0.4960 | 0.4980 | 0.4970 |

| June | 0.4960 | 0.4980 | 0.4970 |

| July | 0.4890 | 0.4980 | 0.4935 |

| August | 0.4880 | 0.4900 | 0.4890 |

| September | 0.4900 | 0.4920 | 0.4910 |

| October | 0.4890 | 0.4920 | 0.4905 |

| November | 0.4870 | 0.4890 | 0.4880 |

| December | 0.4860 | 0.4880 | 0.4870 |

Danish Krone to Zloty Forecast for 2030

In early 2030, the Danish Krone (DKK) to Polish Zloty (PLN) exchange rate continues its downward trajectory, reflecting persistent bearish sentiment. Monthly data shows consistent declines across all measured periods, indicating ongoing pressure on the krone.

| Month |

Min Rate |

Max Rate |

Average Rate |

| January | 0.484 | 0.486 | 0.4850 |

| February | 0.483 | 0.484 | 0.4835 |

| March | 0.480 | 0.483 | 0.4815 |

| April | 0.476 | 0.480 | 0.4780 |

What Affects the DKK/PLN Rate?

The DKK versus Polish zloty rate is influenced by the relative economic performances and monetary policies of Denmark and Poland. Key factors include but are not limited to:

- GDP growth. If Denmark's economy expands faster than Poland's, the krone tends to appreciate versus the zloty.

- Inflation rate differences. Higher inflation erodes purchasing power, so if Poland's inflation runs hotter than Denmark's, the zloty typically weakens. More moderate inflation in Denmark supports the krone.

- Political stability. Poland has faced recent political tensions, risking economic reforms. Denmark's stable government boosts the krone.

- Interest rate differentials. Higher Polish interest rates make zloty assets more appealing than low-yielding Danish assets, lifting the zloty.

- Technical trading factors. Trends, support/resistance levels, volatility and other technical indicators impact short-term DKK/PLN fluctuations.

How to predict the DKK/PLN exchange rate

Forecasting the Danish krone to Polish zloty exchange rate requires analyzing a mix of fundamental economic factors and technical trends.

Monitoring key data like GDP, inflation, fiscal deficits, interest rates, and political developments in both countries offers insight into macro forces driving the pair. Comparing the differences between Denmark and Poland determines whether broad fundamentals favor the krone or the zloty. Additionally, studying price charts of the asset, resistance and support levels, trading volumes, volatility, and indicator momentum helps assess market psychology and directional biases over different timeframes.

Blending both fundamental intermarket analysis and technical intramarket analysis allows for predicting whether the DKK/PLN rate will appreciate, depreciate, or consolidate going forward.

Conclusion

In summary, the current Danish krone to Polish zloty forecast indicates a generally bearish trend for the Danish krone against the Polish zloty throughout 2025 and into 2026. While the DKK forecast shows resilience due to Denmark’s strong economic fundamentals, the DKK PLN exchange rate has been under pressure, with minor recoveries expected only periodically. The Danish krone to Polish zloty trend suggests that any upside movements may be limited in the near term.

Holding Danish krone exposure still offers a balanced risk-reward profile, supported by Denmark’s economic and political stability. However, given the current DKK dynamics, investors should closely monitor European inflation trends, economic growth data, and technical signals for better timing of entries or exits in DKK PLN trading.

FAQs

Will Polish Zloty get stronger against Danish Krone in 2025?

In 2025, the Polish zloty is expected to strengthen moderately against the DKK. According to the current DKK PLN forecast, the Danish krone to Polish zloty exchange rate shows a bearish trend, reflecting Poland’s stabilizing economy and easing inflation.

What is the forecast for DKK to PLN in 2026?

The DKK to PLN forecast in 2026 suggests a continued bearish trend, with the DKK gradually weakening against the Polish zloty throughout the year.

Will the Danish Krone to Zloty exchange rate fall / drop?

Significant downside is unlikely, barring an unexpected crisis in Denmark or a surge in Polish growth. Experts predict a quite stable DKK PLN rate in the future with a slight possible decrease.

What will the DKK/PLN FX rate be worth in five years (2030)?

Over a five-year horizon, the Krone is expected to maintain a steady course, with the possibility for slight depreciation.

Will the DKK/PLN FX rate crash?

While fluctuations are normal, a drastic crash seems unlikely given the current economic landscape.

Will DKK to PLN exchange rate hit "1" in a year?

Reaching a one-to-one exchange rate would require significant shifts in economic conditions, which are not currently forecasted.