Natural Gas Forecast & Price Predictions for 2025, 2030 and Beyond

Table of Contents

Key Takeaways

Natural Gas Price Forecast & Price Prediction – Summary

Natural Gas Prices Historical Overview

Natural Gas Price Forecast - Technical Outlook

What Affects Natural Gas Prices?

Short-Term Natural Gas Price Forecast for 2025

Gas Price Forecasts for the Next 5 Years

Natural Gas Forecast for 2030–2050

Conclusion: What Is the Future of Natural Gas?

FAQs

Key Takeaways

- Natural gas values may increase modestly by 2030

- Market influenced by global demand and energy transition

- Policy shifts and renewables add uncertainty

- Geopolitics and supply trends may drive volatility

Natural Gas Price Forecast & Price Prediction – Summary

The natural gas market is poised for notable shifts through 2030. The U.S. Energy Information Administration (EIA) projects the Henry Hub natural gas spot price to average $4.20 per million British thermal units (MMBtu) in 2025, rising to $4.50/MMBtu in 2026. This increase is driven by heightened natural gas demand, particularly from expanding liquefied natural gas (LNG) export facilities and robust domestic consumption.

Concurrently, natural gas inventories are anticipated to decline, exerting upward pressure on natural gas prices. The surge in natural gas futures reflects market expectations of tighter supply-demand balances. However, infrastructure constraints and rising costs may lead to less natural gas availability for exports, potentially impacting global gas prices.

Looking ahead, the EIA forecasts a gradual increase in Henry Hub natural gas prices, reaching $4.60/MMBtu in 2026. These projections underscore the evolving dynamics of the natural gas market, influenced by factors such as electricity generation, storage levels, and crude oil production trends.

| Year |

Henry Hub Price (USD/MMBtu) |

| 2025 | $4.20 |

| 2026 | $4.50 |

| 2027 | $4.60 |

| 2028 | $4.70 |

| 2029 | $4.80 |

| 2030 | $4.90 |

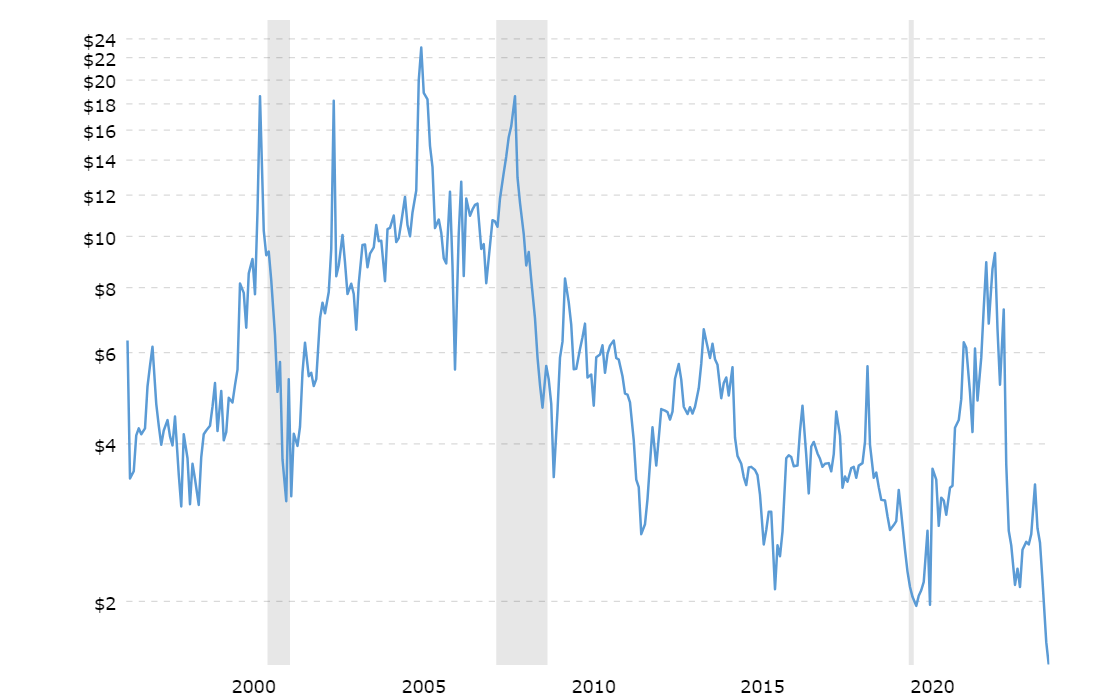

Natural Gas Prices Historical Overview

The historical movement of natural gas prices can be divided into distinct phases, each characterized by unique conditions and events. Let’s have a closer look.

- Early 2000s: At first, natural gas prices were pretty steady, but they started to climb as the need for gas to make electricity increased. Sadly, not enough infrastructure meant prices sometimes shot up, showing how tight the balance between supply and demand was.

- Mid-2000s: Hydraulic fracturing and horizontal drilling were game changers that unlocked loads of shale gas. This technological revolution led to a significant increase in dry natural gas production. As a result, the market soon found itself in an oversupply condition, which caused a sharp decline in prices and the necessity to reshape energy policies and natural gas consumption patterns worldwide.

- Impact of the 2008 Financial Crisis: The 2008 financial crisis hit hard, and natural gas values were no exception. With economies slowing down, the demand for energy dropped, pulling down gas prices. But as things started to improve, so did the demand for gas, slowly pushing prices back up.

- Seasonal Fluctuations and Liquid Natural Gas (LNG) Exports: Seasonal demand, especially during the harsh winter heating season, led to temporary price spikes. The emergence of LNG export capabilities linked domestic prices more closely with the global gas markets, adding a new layer of complexity.

- Recent Geopolitical and Supply Chain Influences: The natural gas world is often shaken by political events and supply chain problems. The recent troubles between Russia and Ukraine are a prime example. Prices jumped because of the uncertainty, showing how sensitive the market is to global events. This has made countries and companies think hard about where they get their energy from.

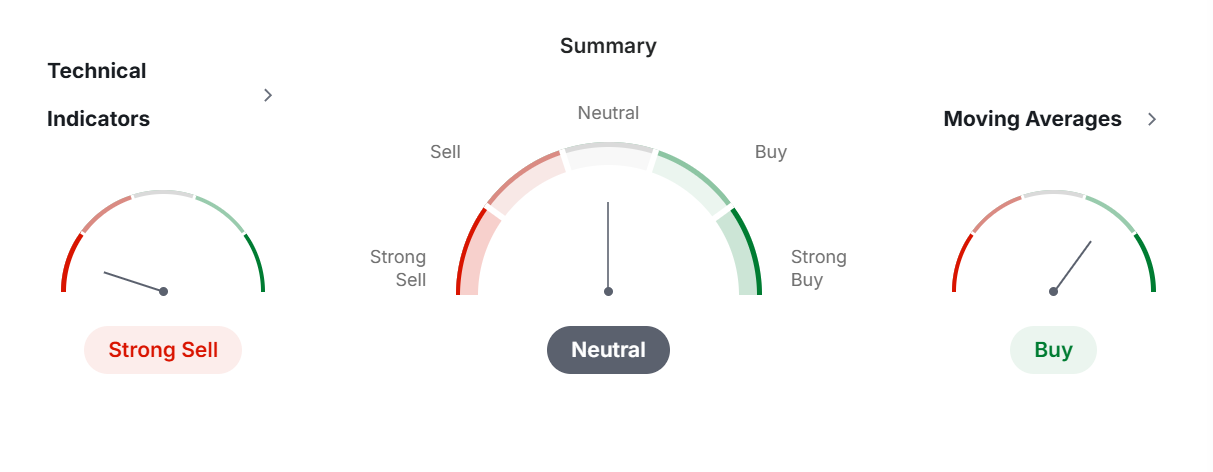

Natural Gas Price Forecast - Technical Outlook

The natural gas cost forecast indicates continued volatility, driven by supply-demand dynamics and global economic factors. In the short term, Henry Hub natural gas prices may experience fluctuations as natural gas futures react to oil price movements and weather patterns.

As per the EIA forecast, increased need for liquefied natural gas (LNG) exports and potential tariffs may push gas prices higher, although historical data suggests that volatility will persist, particularly in the third quarter and fourth quarter of 2025.

Prices are expected to increase gradually, with projections aligning with the five-year average, but uncertainty and cost pressures may limit significant increases. Continued trading activity and production trends will influence the natural gas market, while winter conditions could alter the price forecast.

)

What Affects Natural Gas Prices?

There are several factors that play a crucial role in shaping natural gas costs, intertwining to create a complex market landscape. Let’s have a look at them.

- Production Levels: The amount of natural gas we're able to pump out of the ground is a big deal. Discovering new methods to increase production or finding fresh gas fields can significantly alter the available supply. This can lead to changes in prices, either driving them up or bringing them down, depending on how the supply adjusts.

- Pipelines: Pipelines are like highways, allowing natural gas to travel on to get to its final destination. Any issues or expansions during this transportation process impact how quickly and how much pipeline gas gets to us, influencing prices in the process.

- Demand for Power: Natural gas plays a crucial role in powering our electricity needs. Changes in how much electricity we need, often due to the economy's health or the seasons, can affect how much natural gas we use, which, in turn, can influence its prices.

- Heating in Winter: When it gets cold, we all turn up the heat, which usually means using more natural gas. This jump in demand can really push natural gas values higher.

- Global Trade: Political events, new trade agreements, or changes in the world's energy needs can make the natural gas value go up or down.

- Henry Hub Prices: As a key reference point for natural gas pricing in North America, the Henry Hub benchmark helps set the price for gas all over North America, and even impacts prices around the world.

- Storage Levels: Significant deviations in natural gas inventories hint that prices might be about to change. Surplus inventories are typically a potential sign of downward pressure on prices, and deficits usually lead to upward trends.

Short-Term Natural Gas Price Forecast for 2025

The natural gas price forecast for 2025 indicates significant fluctuations, influenced by factors such as natural gas demand, exports, and weather conditions. According to WalletInvestor, Henry Hub natural gas prices are projected to average $3.681 per MMBtu in April, decreasing to $3.248 in May, and further to $2.930 by June. By December, prices are expected to increase to an average of $3.093 per MMBtu.

The following table summarizes the projected Henry Hub natural gas prices for 2025:

| Month |

Min Price |

Max Price |

Avg Price |

| April | $2.036 | $5.251 | $3.681 |

| May | $1.885 | $5.131 | $3.248 |

| June | $2.122 | $5.194 | $2.930 |

| July | $2.070 | $5.203 | $3.650 |

| August | $2.167 | $5.383 | $3.635 |

| September | $2.007 | $5.136 | $3.627 |

| October | $2.128 | $5.173 | $3.621 |

| November | $2.139 | $5.081 | $3.620 |

| December | $2.068 | $5.154 | $3.093 |

Gas Price Forecasts for the Next 5 Years

The natural gas price forecast over the next five years indicates a downward trend, influenced by factors such as expanding LNG export facilities, fluctuating natural gas demand, and evolving supply dynamics. The Henry Hub natural gas prices are projected to decrease from an average of $3.00 per MMBtu in 2025 to approximately $0.72 per MMBtu by 2030.

This decline reflects anticipated increases in natural gas production, potential reduced demand scenarios, and shifts in consumption patterns. Additionally, the expansion of LNG exports and changes in storage capacities contribute to the forecasted price movements.

The following table summarizes the projected natural gas prices:

| Year |

Henry Hub Natural Gas Cost (USD/MMBtu) |

| 2025 | $3.00 |

| 2026 | $2.60 |

| 2027 | $2.20 |

| 3028 | $1.80 |

| 2029 | $1.30 |

| 2030 | $0.78 |

These projections underscore the importance of monitoring natural gas futures and market indicators to navigate the evolving natural gas market landscape.

Natural Gas Forecast for 2030-2050

The natural gas price forecast for 2030–2050 reflects a complex interplay of market dynamics, policy shifts, and technological advancements. According to Deloitte, Henry Hub prices are projected to average $4.40/MMBtu in 2030, rising to $4.60 by 2032, with an anticipated annual increase of 2% thereafter. This gradual uptick in natural gas futures is influenced by factors such as crude oil price trends, imports, and global energy demand.

However, the natural gas market faces uncertainties. The EIA forecast suggests that while natural gas will continue to play a role in the first quarter of the century, its share in the energy mix may decline by the fourth quarter due to increased adoption of renewables and efforts to reduce demand for fossil fuels. Additionally, geopolitical factors, such as tariffs and energy policies in various countries, add layers of risk and uncertainty to long-term price forecasts.

In Europe, the transition to cleaner energy sources is expected to impact natural gas operations, with a potential fall in demand influencing prices. Nevertheless, natural gas remains a critical commodity for residential and industrial sectors, and its role in energy production will continue to evolve based on data, analysis, and industry trends.

Conclusion: What Is the Future of Natural Gas?

Natural gas is expected to have a bright future, thanks to a potential increase in demand and its reputation as a cleaner energy choice. As the world leans more towards sustainable energy, natural gas is set to become increasingly important. This is why many experts foresee a gentle rise in its prices, driven by its key role in heating our homes during winter, as well as the growth of gas pipelines.

Right now, natural gas has a rather low price level, which might make it a smart pick for long-term investments, especially if prices start to increase in the coming months. However, just as with any type of investment, it's crucial for traders to do their homework and make sure any moves fit well with their trading approach and risk comfort level. Remember that to make more informed decisions, it’s important to keep up with the latest trends in natural gas production and the overall energy market.

FAQs

What is the future prediction for natural gas?

The natural gas forecast suggests moderate growth, driven by evolving energy demands. Experts expect price volatility in the upcoming weeks, as outlined in the latest report.

What is the EU natural gas forecast?

The EU natural gas forecast indicates declining demand as the region shifts toward renewables, energy efficiency, and emissions targets, reducing reliance on fossil fuel imports.

What is the future of natural gas in 2025?

In 2025, the natural gas need is projected to increase, driven by increased exports and domestic consumption, while market volatility and supply constraints may influence pricing.

Will natural gas prices decrease or increase during 2025?

Natural gas costs in 2025 are expected to fluctuate, with periods of increase due to export demand and weather, but potential declines from strong supply growth.

Will natural gas prices rise in the next 5 years?

Natural gas values are projected to experience modest growth over the next five years, influenced by increasing global demand and evolving energy market dynamics.

What are the natural gas price predictions for 2030?

Natural gas costs in 2030 are projected to experience modest growth, influenced by global demand, energy transitions, and market dynamics. Analysts anticipate fluctuations due to factors like renewable energy adoption, policy changes, and geopolitical events.