USD/JPY Forecast for 2025 and Beyond

)

Table of Contents

Key Takeaways

USD/JPY Currency Rate Forecast Summary

Short-term USD/JPY price forecast for 2024

USD/JPY technical analysis

USD/JPY Price History

USD/JPY Forecast for 2025

USD/JPY Forecast for 2026

USD/JPY Forecast for 2027

USD/JPY Forecast for 2028

What Affects the Dollar to Yen Rate?

How to Predict the Dollar to Yen Exchange Rate

Conclusion

FAQs

With the Japanese national currency being one of the top Forex traders’ choices, the yen exchange rate forecast is always a big question. This article provides insights into experts’ opinions about the future of the Japanese yen, as well as technical analysis of the pair rate, and predictions from 2025 to 2028. Aside from seeing the Japanese yen forecast, you will also find out what factors define its price, and how to make data-driven projections.

Key Takeaways

- Near-term outlook: the upward impulse has weakened, with USD/JPY trading below the 200-day moving average. Support around ¥140 has prevented deeper losses, while resistance near ¥145 is limiting upside momentum.

- Mid-term outlook: the pair remains range-bound between ¥140–145. A sustained breakout above ¥160 would be required to shift the neutral outlook back to bullish.

- Long-term outlook: the broader trend structure stays upward. For the dollar to unlock further gains, it must reclaim long-term support levels, which could pave the way toward ¥200 over the extended horizon.

- Yearly projections: forecasts show highs near ¥155 in 2026, followed by a wide range in 2027 between ¥124–151. In later years, volatility narrows, with projected ranges consolidating around ¥134–147 in 2028 and ¥130–139 by 2030.

USD/JPY Currency Rate Forecast Summary

The USD/JPY interest rate is projected to experience alternating phases of stability and volatility over the forecast horizon, influenced by monetary policy shifts, global trade dynamics, and broader economic conditions. The table below outlines the anticipated annual ranges:

| Year |

Projected Low |

Projected High |

| 2025 | ¥ 146.22 | ¥ 152.43 |

| 2026 | ¥ 142.16 | ¥ 155.72 |

| 2027 | ¥ 124.46 | ¥ 151.04 |

| 2028 | ¥ 134.09 | ¥ 147.19 |

| 2029 | ¥ 130.42 | ¥ 142.48 |

| 2030 | ¥ 130.93 | ¥ 139.61 |

The outlook suggests that the early years are likely to remain within relatively contained ranges, supported by monetary stability and moderate economic performance. Midway through the forecast horizon, volatility is expected to intensify, with wider trading corridors reflecting sharper corrections and temporary yen strength. This period underscores the risk posed by policy divergence and shifting investor sentiment.

Toward the later part of the cycle, the pair is projected to move into a phase of narrower ranges, signaling consolidation and reduced volatility. This pattern aligns with potential normalization in interest rate differentials and a more balanced global outlook.

Overall, the forecast points to cyclical adjustments rather than a sustained one-way trend, highlighting the importance of monitoring macroeconomic releases and central bank guidance as key drivers of direction.

USD/JPY technical analysis

)

USD/JPY fell sharply from mid-February to April, then rebounded and stabilized. Through summer it traded in a broad range, peaking near 150 in July–August and consolidating around 147 by late August.

)

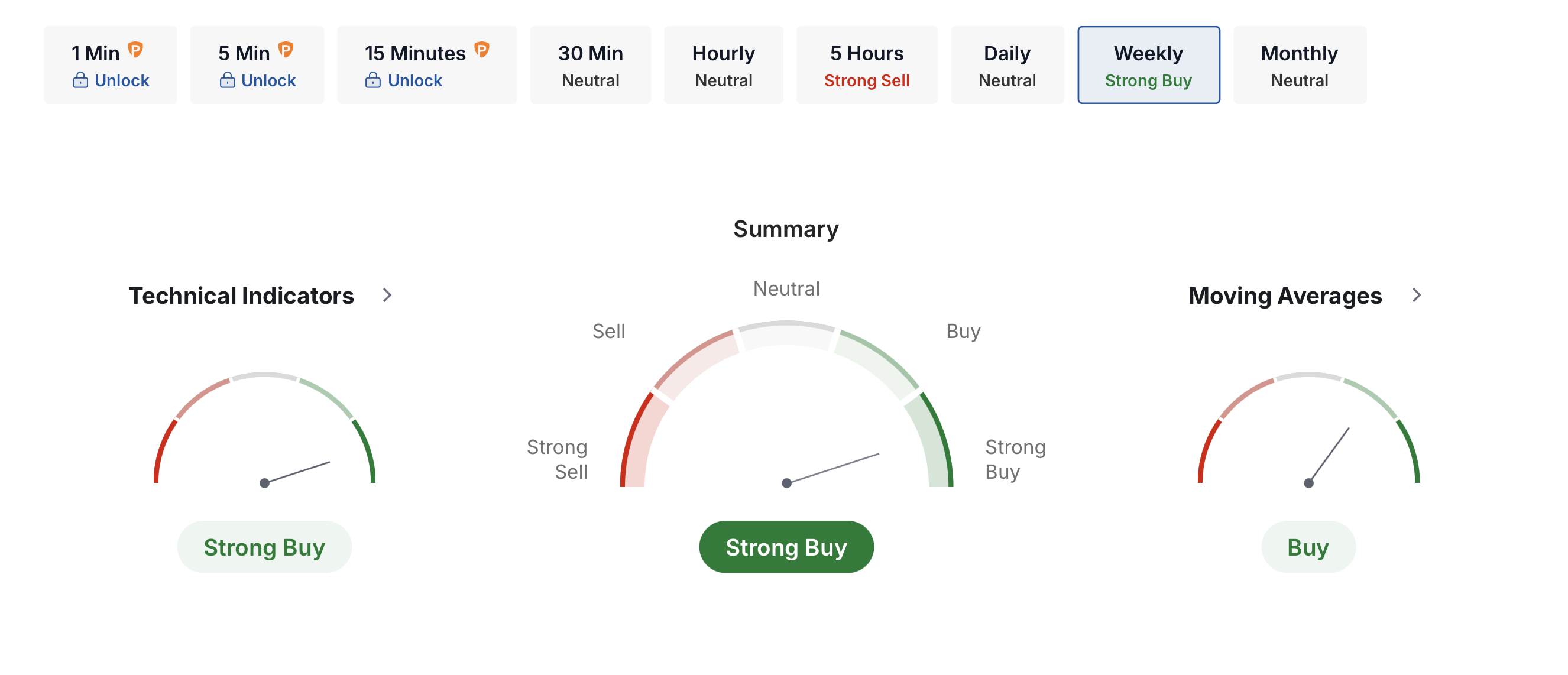

The weekly chart reflects a bullish outlook. Technical indicators issue a strong buy signal, pointing to upward momentum in the pair. The overall summary likewise shows a strong buy stance, reinforcing the prevailing bullish sentiment. Moving averages lean supportive as well, giving a buy signal and aligning with the broader positive view on the weekly timeframe.

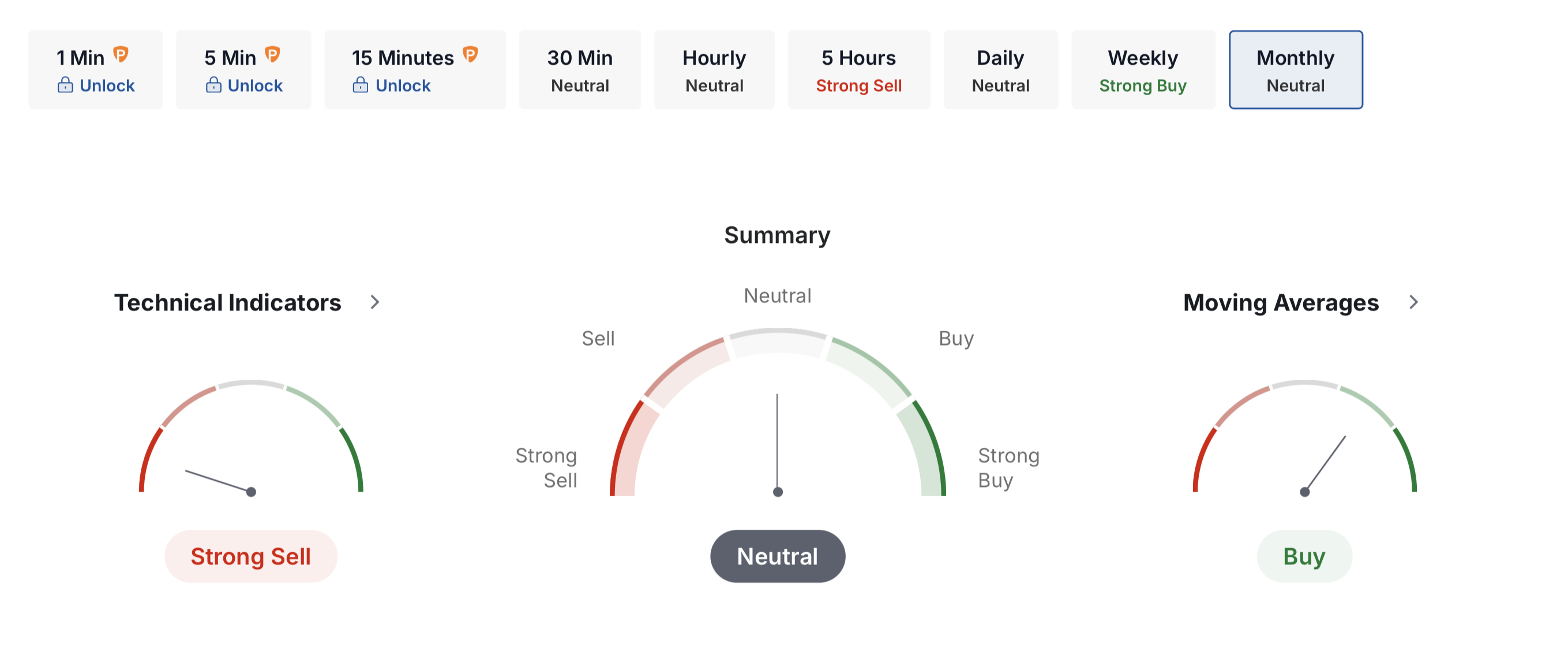

On the monthly timeframe, the outlook is neutral. Technical indicators point to a strong sell signal, highlighting prevailing downside risks, while moving averages issue a buy signal.

The breakdown shows that moving averages are moderately positive, with 7 buy signals against 5 sell, suggesting underlying support for the pair. By contrast, technical indicators emphasize bearish momentum, with 6 sell signals and only 2 buy, pulling the overall assessment back into a neutral stance.

This divergence indicates mixed market conditions: longer-term trend measures lean constructive, but momentum-based indicators continue to warn of selling pressure.

USD/JPY Price History

Throughout 2024, the exchange rate between the US Dollar (USD) and the Japanese Yen (JPY) exhibited significant fluctuations, influenced by various economic factors and monetary policies.

The USD/JPY pair reached its highest point at 161.62 JPY per USD on July 3, 2024, and its lowest at 140.66 JPY per USD on September 16, 2024. The average exchange rate for the year was approximately 151.45 JPY per USD.

The table below presents the average monthly exchange rates for USD to JPY in 2024:

| Month |

Average Rate |

| January | 146.01 |

| February | 149.60 |

| March | 149.76 |

| April | 153.89 |

| May | 155.84 |

| June | 157.91 |

| July | 157.62 |

| August | 146.07 |

| September | 143.11 |

| October | 149.91 |

| November | 153.56 |

| December | 154.10 |

These fluctuations were driven by factors such as percentage rate differentials between the Federal Reserve and the Bank of Japan, economic data releases, and geopolitical events.

For instance, the yen's depreciation in July was partly due to the Bank of Japan's decision to maintain its ultra-loose monetary policy, contrasting with the Federal Reserve's tightening stance. Conversely, the yen strengthened in September amid expectations of potential rate hikes by the Bank of Japan to address rising inflation.

These dynamics underscore the importance for traders and investors to closely monitor economic indicators and central bank policies when engaging in the USD/JPY currency pair.

USD/JPY Forecast for 2025

The USD/JPY exchange rate is expected to maintain a generally upward trend through the second half of 2025, though volatility will remain visible across the months. In August, the rate may register a minimum of ¥146.22, with an average level of ¥146.82 and a peak of ¥147.95. September could see a slight pullback, with a minimum at ¥144.41, an average of ¥145.65, and highs approaching ¥148.93.

October is projected to show the widest swings, as the pair may dip to ¥143.46 but average ¥147.23 and climb to ¥150.77, reflecting the strongest volatility of the year. November continues the bullish move, averaging ¥148.00 with highs around ¥151.07. By December, the pair consolidates at higher ground, averaging ¥149.36 and setting the yearly high near ¥152.43.

The table below outlines the projected monthly exchange rates for USD/JPY in 2025:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| August | ¥ 146.22 | ¥ 146.82 | ¥ 147.95 | 0.50% |

| September | ¥ 144.41 | ¥ 145.65 | ¥ 148.93 | 1.16% |

| October | ¥ 143.46 | ¥ 147.23 | ¥ 150.77 | 2.41% |

| November | ¥ 146.81 | ¥ 148.00 | ¥ 151.07 | 2.62% |

| December | ¥ 147.41 | ¥ 149.36 | ¥ 152.43 | 3.54% |

Overall, these projections suggest a bullish trajectory for the U.S. dollar against the yen, marked by periods of heightened volatility. October appears as the most turbulent month, while the end of the year signals a stronger dollar. Investors should remain attentive to short-term corrections, but the broader outlook points to continued appreciation.

USD/JPY Forecast for 2026

The USD to JPY forecast suggests moderate fluctuations in the exchange rate throughout 2026, shaped by interest rate differentials, central bank policies, and broader economic movements. The Japanese yen forecast indicates phases of relative weakness, particularly in the spring and early summer, while showing periods of recovery toward the end of the year.

Analysts expect the pair to start at around ¥151.85 in January and potentially fluctuate within the range of ¥145.99 in April to ¥153.77 by December. Traders should closely monitor upcoming economic reports, monetary policy announcements, and geopolitical developments, as these may trigger short-term volatility in the forex market.

The following table presents the projected USD JPY price movements for 2026:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| January | ¥ 147.89 | ¥ 151.85 | ¥ 155.72 | +5.78% |

| February | ¥ 150.92 | ¥ 152.29 | ¥ 155.68 | +5.75% |

| March | ¥ 148.89 | ¥ 151.10 | ¥ 153.02 | +3.94% |

| April | ¥ 142.16 | ¥ 145.99 | ¥ 151.79 | +3.11% |

| May | ¥ 144.36 | ¥ 146.56 | ¥ 150.35 | +2.13% |

| June | ¥ 144.56 | ¥ 146.48 | ¥ 149.48 | +1.54% |

| July | ¥ 145.02 | ¥ 148.94 | ¥ 152.71 | +3.73% |

| August | ¥ 148.24 | ¥ 149.64 | ¥ 152.46 | +3.56% |

| September | ¥ 148.16 | ¥ 149.58 | ¥ 150.59 | +2.29% |

| October | ¥ 147.48 | ¥ 149.62 | ¥ 151.27 | +2.75% |

| November | ¥ 149.99 | ¥ 152.68 | ¥ 153.86 | +4.51% |

| December | ¥ 149.74 | ¥ 151.41 | ¥ 153.77 | +4.45% |

These currencies are expected to remain sensitive to external drivers such as global trade policies, tariffs, and commodity imports. The yen forecast may shift in response to changes in monetary policy by the Bank of Japan and the Federal Reserve, as well as broader forex market reactions. Traders should remain attentive to potential breaks in key support or resistance levels, alongside market-moving events such as global central bank guidance or significant shifts in international trade flows.

The dollar forecast remains cautiously bullish, with expectations of a gradual uptrend, particularly in the opening and closing months of the year. However, unexpected downturns in financial markets, economic slowdowns, or geopolitical shocks could alter projections. Those trading the USD/JPY pair should remain alert to volatility, risk, and heightened economic uncertainty.

USD/JPY Forecast for 2027

The USD to JPY forecast for 2027 points to a year of contrasting dynamics, with the yen expected to strengthen notably through the summer months before showing signs of recovery at year-end. Analysts anticipate the exchange rate to begin near ¥147.54 in January, gradually declining to the low range of around ¥126.10 by August, before rebounding toward ¥144.45 by December. This movement reflects the influence of shifting interest rate expectations, central bank policies, and broader global economic conditions.

The table below outlines the projected monthly exchange rates for USD/JPY in 2027:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| January | ¥ 145.19 | ¥ 147.54 | ¥ 151.04 | +2.60% |

| February | ¥ 138.99 | ¥ 142.74 | ¥ 151.01 | +2.58% |

| March | ¥ 138.56 | ¥ 140.73 | ¥ 142.26 | +3.37% |

| April | ¥ 132.43 | ¥ 136.74 | ¥ 140.15 | +4.80% |

| May | ¥ 131.81 | ¥ 135.43 | ¥ 138.51 | +5.91% |

| June | ¥ 126.59 | ¥ 131.43 | ¥ 138.44 | +5.96% |

| July | ¥ 125.21 | ¥ 129.32 | ¥ 133.53 | +9.30% |

| August | ¥ 124.46 | ¥ 126.10 | ¥ 128.31 | +12.84% |

| September | ¥ 124.94 | ¥ 127.17 | ¥ 129.53 | +12.01% |

| October | ¥ 125.87 | ¥ 129.00 | ¥ 131.16 | +10.91% |

| November | ¥ 127.93 | ¥ 134.69 | ¥ 141.48 | +3.89% |

| December | ¥ 140.52 | ¥ 144.45 | ¥ 147.27 | +0.04% |

These projections indicate that the dollar may face pressure against the yen through the middle of the year, reaching its weakest point during August–September, before regaining strength into the final quarter. Traders should follow central bank communications, particularly from the Bank of Japan and the Federal Reserve, alongside global trade negotiations and geopolitical risks, which could significantly influence market sentiment and exchange rate volatility.

The dollar outlook remains cautiously optimistic toward year-end, but the mid-year period is likely to present heightened risks and opportunities, especially for short-term strategies. Market participants are advised to remain attentive to shifts in interest rate policies and unexpected macroeconomic developments that could reshape the trajectory of the USD/JPY pair.

USD/JPY Forecast for 2028

The USD to JPY forecast for 2028 suggests moderate fluctuations across the year, shaped by monetary policy shifts, interest rate differentials, and broader global trade conditions. Analysts expect the exchange rate to commence near ¥143.50 in January, move toward a low of around ¥136.72 in August, and conclude the year close to ¥140.63 in December.

This trajectory reflects the influence of central bank decisions and trade-related developments, with potential tariffs and geopolitical risks adding further uncertainty. Traders should monitor key macroeconomic releases and policy guidance from the Federal Reserve and the Bank of Japan, as these will remain the primary drivers of USD/JPY movements during the year.

The table below outlines the projected monthly exchange rates for USD/JPY in 2028:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| January | ¥ 140.49 | ¥ 143.50 | ¥ 147.19 | +0.02% |

| February | ¥ 139.27 | ¥ 140.66 | ¥ 142.67 | +3.08% |

| March | ¥ 137.35 | ¥ 140.75 | ¥ 143.72 | +2.37% |

| April | ¥ 134.92 | ¥ 137.22 | ¥ 138.88 | +5.66% |

| May | ¥ 137.88 | ¥ 139.75 | ¥ 142.27 | +3.36% |

| June | ¥ 136.23 | ¥ 138.09 | ¥ 140.25 | +4.73% |

| July | ¥ 137.33 | ¥ 139.90 | ¥ 142.42 | +3.26% |

| August | ¥ 135.31 | ¥ 136.72 | ¥ 138.02 | +6.24% |

| September | ¥ 134.09 | ¥ 137.84 | ¥ 140.66 | +4.46% |

| October | ¥ 139.22 | ¥ 140.64 | ¥ 142.15 | +3.44% |

| November | ¥ 138.31 | ¥ 140.51 | ¥ 142.43 | +3.25% |

| December | ¥ 139.62 | ¥ 140.63 | ¥ 141.48 | +3.90% |

These projections highlight the likelihood of a softer yen during the summer months and a stabilization of the exchange rate toward year-end. Investors should remain attentive to evolving economic indicators and global events that could introduce volatility, and adjust their trading strategies to account for potential market swings.

USD/JPY Forecast for 2029

The USD to JPY forecast for 2029 points to a year marked by sharp contrasts. The exchange rate is expected to open near ¥138.17 in January, slide to its weakest levels around ¥132.02 in March, and then regain ground to end the year close to ¥139.71 in December. This path suggests a volatile first quarter, where the yen may briefly strengthen before the dollar gradually recovers over the rest of the year.

The movement is closely tied to interest rate dynamics and economic policy signals. A soft start could be amplified by uncertainty in early macroeconomic releases, while the steady recovery later in the year reflects a more balanced environment for the pair. Traders should pay attention to the turning point in spring, when sentiment may shift from defensive to more optimistic, setting the tone for the second half of the year.

The table below outlines the projected monthly exchange rates for USD/JPY in 2029:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| January | ¥ 135.22 | ¥ 138.17 | ¥ 141.02 | +4.21% |

| February | ¥ 131.86 | ¥ 134.41 | ¥ 137.23 | +6.78% |

| March | ¥ 130.42 | ¥ 132.02 | ¥ 133.28 | +9.47% |

| April | ¥ 131.84 | ¥ 134.02 | ¥ 136.23 | +7.46% |

| May | ¥ 135.20 | ¥ 136.60 | ¥ 138.63 | +5.83% |

| June | ¥ 135.95 | ¥ 137.06 | ¥ 137.96 | +6.28% |

| July | ¥ 137.54 | ¥ 138.74 | ¥ 140.77 | +4.38% |

| August | ¥ 136.96 | ¥ 138.27 | ¥ 139.52 | +5.23% |

| September | ¥ 137.71 | ¥ 139.53 | ¥ 141.79 | +3.69% |

| October | ¥ 139.25 | ¥ 140.42 | ¥ 142.48 | +3.21% |

| November | ¥ 140.07 | ¥ 141.10 | ¥ 142.04 | +3.52% |

| December | ¥ 136.55 | ¥ 139.71 | ¥ 141.53 | +3.86% |

Rather than showing a smooth upward climb, the 2029 forecast emphasizes a mid-year stabilization after early turbulence. Investors should be ready for heightened volatility in the first quarter, when the yen could appear stronger, and then prepare for more measured, range-bound moves as the dollar gradually regains momentum into the year’s close.

USD/JPY Forecast for 2030

The USD to JPY forecast for 2030 reflects a year characterized by alternating phases of appreciation and correction rather than a sustained directional trend. The exchange rate is projected to begin near ¥135.72 in January, advance toward a local high around ¥139.11 in April, and subsequently decline into the ¥132–134 range during the summer months. By December, the pair is expected to consolidate at approximately ¥135.97, indicating that the year may close with values close to those observed at the start.

The forecast highlights the presence of cyclical volatility. The first quarter points to gradual strengthening of the dollar, followed by a corrective movement in mid-year, with August and September representing the lowest price levels and the highest potential returns (ROI above 7.5%, peaking at 8.36% in September). The final quarter suggests stabilization within a narrow corridor around ¥135–136, indicating reduced volatility compared to earlier periods.

The table below outlines the projected monthly exchange rates for USD/JPY in 2030:

| Month |

Min. Price |

Avg. Price |

Max. Price |

Potential ROI |

| January | ¥ 133.73 | ¥ 135.72 | ¥ 136.76 | +7.10% |

| February | ¥ 135.64 | ¥ 137.41 | ¥ 138.98 | +5.59% |

| March | ¥ 136.87 | ¥ 138.41 | ¥ 139.45 | +5.27% |

| April | ¥ 138.17 | ¥ 139.11 | ¥ 139.61 | +5.16% |

| May | ¥ 134.87 | ¥ 137.02 | ¥ 138.92 | +5.64% |

| June | ¥ 133.25 | ¥ 134.59 | ¥ 135.35 | +8.06% |

| July | ¥ 133.86 | ¥ 134.79 | ¥ 135.80 | +7.75% |

| August | ¥ 130.93 | ¥ 132.22 | ¥ 135.95 | +7.65% |

| September | ¥ 131.96 | ¥ 133.86 | ¥ 134.91 | +8.36% |

| October | ¥ 133.01 | ¥ 134.67 | ¥ 135.73 | +7.80% |

| November | ¥ 134.51 | ¥ 135.58 | ¥ 136.46 | +7.31% |

| December | ¥ 135.15 | ¥ 135.97 | ¥ 136.57 | +7.23% |

These projections emphasize the importance of mid-year corrections as key periods of increased return potential, contrasted with relative stability toward the end of the year. The overall trajectory indicates a trading environment dominated by cyclical adjustments rather than persistent appreciation or depreciation, reinforcing the need for precise timing in market positioning.

What Affects the Dollar to Yen Rate?

The USD/JPY exchange rate is influenced by several factors, including:

-

The monetary policies of the Federal Reserve and the Bank of Japan

- Economic indicators (for example, GDP growth and employment rates)

- Geopolitical tensions

- Trade balances

- Investors’ sentiment towards risk

Additionally, fluctuations in global commodity prices (particularly oil), and the overall health of the global economy also play a significant role in shaping the exchange rate between the US dollar and the Japanese yen.

How to Predict the Dollar to Yen Exchange Rate

Predicting the dollar/yen exchange rate involves analyzing economic indicators, central bank policies, geopolitical events, and market sentiment. Utilizing techniques like technical analysis, which examines historical price patterns, and fundamental analysis, which assesses economic factors, can aid in forecasting.

Factors such as interest rate differentials, inflation rates, trade balances, and political stability also impact predictions. Moreover, monitoring news and developments that could affect the US and Japanese economies helps refine yen forecast. However, exchange rate prediction is inherently uncertain due to the complexity of global markets and unforeseen events.

Conclusion

As a popular trading Forex pair, USD/JPY is a nice option for both short and long-term trading. However, before placing your orders, do your research on both currencies and try to analyze their further movements. While the majority of technical AI-generated forecasts imply strengthening of the US dollar, you should keep your finger on the pulse of the market, national economies and geopolitical events.

FAQs

What is the forecast for USD to JPY in 2025?

Analysts’ USD to JPY forecast for 2025 suggests fluctuations within a contained range, with projected lows near ¥146.22 and highs around ¥152.43. Trade-related risks and monetary policy divergence are expected to drive movement, while key U.S. and Japanese data releases will remain critical.

Will the USD to JPY exchange rate fall/drop?

While temporary downside phases are possible, particularly if global uncertainty strengthens demand for the yen, analysts do not expect a sustained breakdown. Forecasts suggest that support is likely to hold above the mid-¥140s, keeping the pair within its broader upward structure.

What will the USD/JPY FX rate be worth in five years (2030)?

By 2030, analysts expect the pair to stabilize within a narrower corridor compared to mid-decade volatility. Forecasts place the range between ¥130.93 on the lower bound and ¥139.61 on the upper bound, reflecting consolidation after broader swings in 2026–2027.

Will the USD/JPY FX rate crash?

A sharp crash is not anticipated. While volatility is likely, especially during the wide trading phases of 2026–2027 (down to ¥124.46 and up to ¥151.04), projections do not suggest a structural breakdown. Instead, movements are expected to follow cyclical adjustments.

Will the USD/JPY exchange rate hit 500 in a year?

Forecasts for the next year remain far below such levels, with expected 2025 trading corridors between ¥146.22–152.43.

Will the USD/JPY exchange rate hit 1000 in a year?

It is highly unlikely that USD/JPY will reach such extreme levels within the next year. Forecasts indicate only moderate fluctuations, with the pair expected to remain within realistic trading ranges rather than experiencing extraordinary surges.