USD to CHF Forecast for 2025 and Beyond

As one of the major driving currencies on the global economic arena, the Swiss Franc is traded in pairs with other fiat currencies, including the US Dollar. If you’re considering trading Dollar / Swiss Franc or want to make a long-term investment, it’s crucial to do thorough research – there are many aspects defining the correlation between these two assets. This article provides a USD/CHF forecast for 2025 and the upcoming years, and explains what impacts the pricing ratio of these two currencies.

Table of Contents

USD TO CHF CURRENCY RATE FORECAST SUMMARY

CHF PRICE FORECAST FOR 2025

CHF PRICE FORECAST FOR 2026

CHF PRICE FORECAST FOR 2027

CHF PRICE FORECAST FOR 2028

USD TO CHF FORECAST FOR 2029

USD TO CHF FORECAST FOR 2030

CHF PRICE HISTORY

USD/CHF technical analysis

WHAT AFFECTS THE CHF PRICE?

HOW TO PREDICT THE PRICE OF CHF

CONCLUSION: IS CHF A GOOD INVESTMENT?

FAQ

USD to CHF Currency Rate Forecast Summary

Current Forecast

The current USD to CHF exchange rate stands at approximately 0.8033, reflecting a stable yet cautious sentiment in the forex market. Recent trends show a gradual decline in the dollar swiss franc pair, driven by divergent monetary policies between the Swiss National Bank (SNB) and the Federal Reserve (Fed), as well as ongoing global economic uncertainties.

Analysts' USDCHF forecasts predict a slightly bearish outlook for the US dollar due to slowing US economic growth and the franc’s reputation as a safe-haven currency. Short-term technical indicators show resistance near 0.8100 and support around 0.7900, with moving averages suggesting a neutral to bearish price action.

| Period |

USD to CHF Forecast |

| End of 2025 |

0.8120 |

| 5-Year Outlook |

0.7450 |

Analyst Expectations

By the end of 2025, the chf forecast predicts a slight strengthening of the swiss franc, driven by global demand for low-risk currencies.

In a 5-year outlook, the USD/CHF exchange rate is forecasted to fall further, potentially reaching 0.7450. This aligns with forex market sentiment, as the franc continues to benefit from economic stability and robust technical analysis signaling long-term strength.

Traders are advised to watch daily basis movements, monitor support and resistance levels, and stay updated on key data releases that could influence the current usd chf levels. Whether you plan to buy, sell, or hold, staying informed is critical for navigating the evolving currency pair dynamics.

CHF price forecast for 2025

Generally, the Swiss Franc forecast based on technical analysis is positive. CHF/USD is expected to keep within the range of 1.08 to 1.19.

| Month |

Min |

Max |

Change |

| January 2025 |

0.876 |

0.910 |

-2.2% |

| February 2025 |

0.844 |

0.876 |

-3.0% |

| March 2025 |

0.844 |

0.876 |

-3.0% |

| April 2025 |

0.844 |

0.876 |

-2.2% |

| May 2025 |

0.840 |

0.866 |

-0.5% |

| June 2025 |

0.824 |

0.853 |

-1.9% |

| July 2025 |

0.837 |

0.867 |

+2.0% |

| August 2025 |

0.854 |

0.882 |

+1.8% |

| September 2025 |

0.869 |

0.905 |

+2.6% |

| October 2025 |

0.892 |

0.928 |

+2.5% |

| November 2025 |

0.874 |

0.914 |

-3.0% |

| December 2025 |

0.847 |

0.887 |

-3.0% |

CHF price forecast for 2026

The Swiss Franc (CHF) is projected to experience fluctuations against the US Dollar (USD) throughout 2026. Analysts anticipate the USD/CHF exchange rate to range between 0.805 and 0.895 during the year, indicating potential volatility. Below is a detailed monthly forecast:

| Month |

Min |

Max |

Change |

| January 2026 |

0.843 |

0.869 |

-0.5% |

| February 2026 |

0.856 |

0.895 |

+3.0% |

| March 2026 |

0.881 |

0.907 |

+1.4% |

| April 2026 |

0.858 |

0.894 |

-2.6% |

| May 2026 |

0.843 |

0.871 |

-1.7% |

| June 2026 |

0.856 |

0.885 |

+1.9% |

| July 2026 |

0.838 |

0.872 |

-2.4% |

| August 2026 |

0.815 |

0.851 |

-2.8% |

| September 2026 |

0.827 |

0.863 |

+2.8% |

| October 2026 |

0.829 |

0.855 |

-0.9% |

| November 2026 |

0.812 |

0.842 |

-2.1% |

| December 2026 |

0.787 |

0.824 |

-3.0% |

CHF price forecast for 2027

The Swiss Franc (CHF) is projected to experience fluctuations against the US Dollar (USD) throughout 2027. Analysts anticipate the USD/CHF exchange rate to range between 0.799 and 0.841 during the year, indicating a potential appreciation of the CHF. Below is a detailed monthly forecast:

| Month |

Min Rate |

Max Rate |

Change (%) |

| January |

0.799 |

0.823 |

+1.5% |

| February |

0.806 |

0.830 |

+0.9% |

| March |

0.818 |

0.854 |

+2.8% |

| April |

0.825 |

0.851 |

-0.4% |

| May |

0.823 |

0.849 |

-0.2% |

| June |

0.810 |

0.836 |

-1.7% |

| July |

0.822 |

0.860 |

+3.0% |

| August |

0.839 |

0.865 |

+0.6% |

| September |

0.830 |

0.856 |

+0.1% |

| October |

0.830 |

0.856 |

+0.1% |

| November |

0.830 |

0.856 |

+0.1% |

| December |

0.830 |

0.856 |

+0.1% |

These projections suggest that the CHF may strengthen against the USD in 2027, with the exchange rate potentially reaching as low as 0.799. However, currency markets are influenced by various factors, including economic data releases and geopolitical events, which can lead to volatility. It's advisable to monitor market developments closely and consult multiple sources for a comprehensive outlook.

CHF price forecast for 2028

Looking ahead to 2028, various financial analysts have provided forecasts suggesting continued volatility for the CHF's performance against the USD. The year is expected to show some recovery for the USD/CHF pair from 2027's lows.

| Month |

Min Rate |

Max Rate |

Change (%) |

| January |

0.728 |

0.750 |

+1.5% |

| February |

0.734 |

0.756 |

+0.8% |

| March |

0.745 |

0.777 |

+2.8% |

| April |

0.752 |

0.774 |

-0.4% |

| May |

0.750 |

0.772 |

-0.3% |

| June |

0.737 |

0.761 |

-1.7% |

| July |

0.748 |

0.782 |

+2.9% |

| August |

0.763 |

0.787 |

+0.6% |

| September |

0.755 |

0.779 |

-0.1% |

| October |

0.767 |

0.791 |

+1.6% |

| November |

0.759 |

0.783 |

-0.1% |

| December |

0.764 |

0.788 |

+0.6% |

These projections indicate that the Swiss Franc may experience modest fluctuations against major currencies in 2028. It's important to note that currency forecasts are subject to change due to various economic factors. Therefore, consulting multiple sources and staying updated with economic developments is advisable for a comprehensive outlook.

USD to CHF for 2029

Looking ahead to 2029, the USD/CHF currency pair is expected to experience mixed trading conditions as investors navigate evolving monetary policies and global economic sentiment. The Swiss franc forecast suggests continued strength, while the dollar faces headwinds from technical indicators pointing to a bearish trend.

| Month |

Min Rate |

Max Rate |

Change (%) |

| January |

0.750 |

0.823 |

-1.7% |

| February |

0.761 |

0.787 |

+1.8% |

| March |

0.771 |

0.795 |

+1.0% |

| April |

0.755 |

0.783 |

-2.2% |

| May |

0.768 |

0.802 |

-2.9% |

| June |

0.764 |

0.820 |

-1.5% |

| July |

0.776 |

0.810 |

+1.2% |

| August |

0.780 |

0.815 |

+0.8% |

| September |

0.775 |

0.835 |

-0.5% |

| October |

0.781 |

0.814 |

+1.1% |

| November |

0.771 |

0.831 |

-1.2% |

| December |

0.777 |

0.831 |

+0.7% |

Based on comprehensive analysis from multiple sources including LongForecast, CoinCodex, WalletInvestor, and Traders Union, the USD CHF exchange rate for 2029 shows divergent expectations. CoinCodex analysts anticipate the currency pair will stabilize around 0.8051 at the start of January, with potential upward momentum driving the price to 0.8296 by mid-year and reaching 0.8314 by December. WalletInvestor expects USDCHF quotes to trade around 0.8320 by the beginning of 2029, with a bearish trend expected to persist throughout the year, potentially falling to 0.8200 in June and 0.8180 by December.

Technical analysis indicates the current USD sentiment remains bearish, with sell signals dominating both daily and weekly timeframes. The Swiss franc continues to represent a safe-haven asset during periods of economic uncertainty, with investors likely to trade the currency pair based on Federal Reserve policy decisions and global risk sentiment. The expected trading range for 2029 spans from 0.750 to 0.835, suggesting significant volatility as the market moment shifts between risk-on and risk-off sentiment throughout the year.

USD to CHF for 2030

As we approach the decade's end, long-term USD/CHF forecasts become increasingly challenging due to the extended timeframe and potential economic variables. Based on available analytical sources, the currency pair is expected to continue its gradual evolution within established technical ranges.

| Period |

Min Rate |

Max Rate |

Source Forecast |

| Q1 2030 |

0.815 |

0.820 |

WalletInvestor |

| Q2 2030 |

0.828 |

0.850 |

Multiple Sources |

| Q3 2030 |

0.824 |

0.845 |

CoinCodex Average |

| Q4 2030 |

0.820 |

0.835 |

Multiple Sources |

| Annual Range (2030) |

0.793 |

0.912 |

Gov Capital |

According to comprehensive analysis from multiple forecasting platforms, the USD CHF exchange rate for 2030 shows significant divergence among analysts. CoinCodex projects the currency pair will average 0.8292 at the beginning of January 2030, experience volatility reaching 0.8281 by June, and stabilize near 0.8240 by December. WalletInvestor provides more conservative estimates, expecting the us dollar swiss franc pair to trade within 0.8150-0.8200 during the first quarter, with prices reaching 0.8150 by the end of March.

Gov Capital presents the most volatile forecast, predicting the chf exchange rate could surge to 0.9119 by early March before trading in an exceptionally wide range of 0.7925-1.0031 throughout the year. This broad range reflects the inherent uncertainty in long-term currency forecasting, particularly for a five-year outlook where technical analysis becomes less reliable.

The Swiss franc is expected to maintain its safe-haven status, with investors likely to trade the currency pair based on global economic sentiment and Federal Reserve policy directions. Current USD trends suggest the dollar may face headwinds, while the franc forecast indicates continued strength during moments of market uncertainty. Technical indicators for such extended periods become less precise, making it essential for traders to monitor shorter-term forecasts and adjust positions accordingly as market conditions evolve week by week.

CHF price history

The Swiss Franc (CHF) has experienced notable fluctuations against the US Dollar (USD) throughout 2024. The CHF has shown mixed performance versus the USD during this period, driven by a number of variables, including monetary policy, economic data, and attitudes in the global market.

| Month |

Average USD/CHF Rate |

| January 2024 | 0.9100 |

| February 2024 | 0.9080 |

| March 2024 | 0.9055 |

| April 2024 | 0.9020 |

| May 2024 | 0.9000 |

| June 2024 | 0.8975 |

| July 2024 | 0.8950 |

| August 2024 | 0.8925 |

| September 2024 | 0.8900 |

| October 2024 | 0.8875 |

| November 2024 | 0.8806 |

| December 2024 | 0.8925 |

The USD/CHF exchange rate demonstrated a consistent declining trend for most of 2024, with the pair starting at 0.9100 in January and reaching its lowest monthly average of 0.8806 in November. However, December showed a modest recovery to 0.8925, indicating some USD strength returning toward year-end. The USD/CHF exchange rate peaked at 0.9195 in April 2024 and fell to a low of 0.8412 in August 2024, showing significant intraday volatility despite the overall declining monthly averages.

The annual average for 2024 was approximately 0.8806, representing a 7.82% increase in USD value against the CHF over the year, though this was primarily driven by the recovery in the final quarter after reaching multi-year lows in the autumn months.

USD/CHF technical analysis

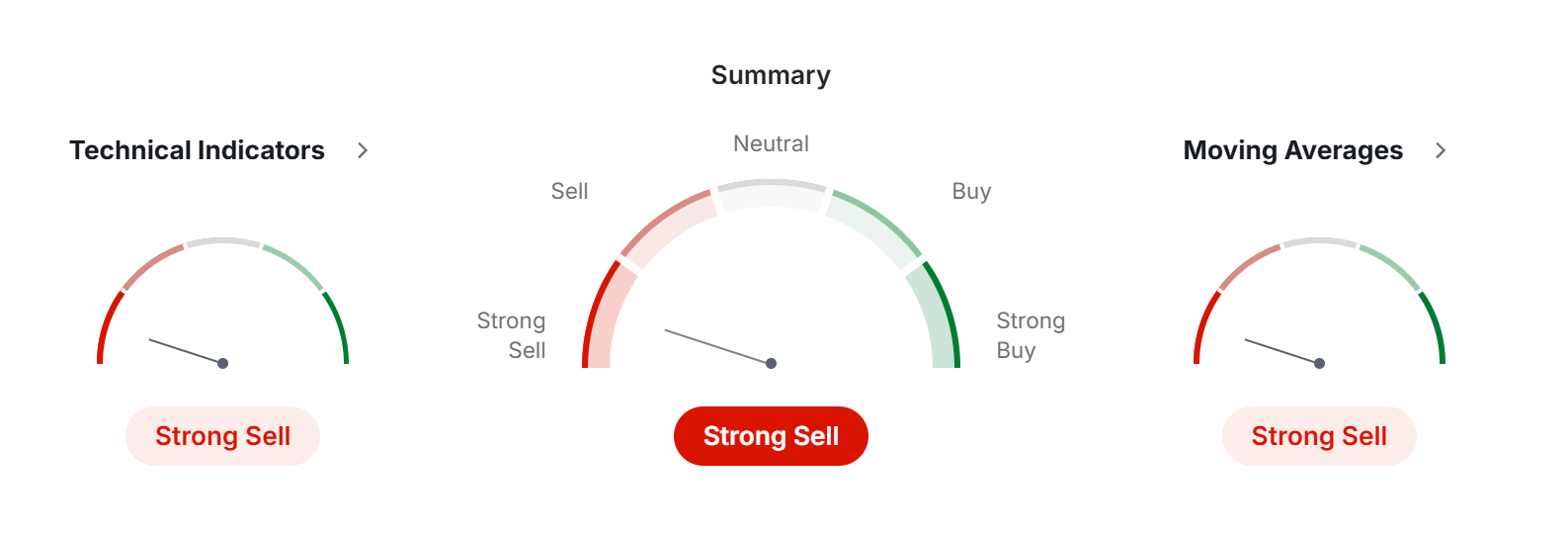

If we observe USD/CHF on a daily time frame, the indicators show a predominantly bearish sentiment. The majority of technical indicators are signaling sell conditions, suggesting downward pressure on the pair. Most oscillators and momentum indicators point towards continued weakness in the USD relative to the CHF, with only a few indicators remaining neutral in their outlook.

)

| Name |

Value |

Action |

| RSI(14) |

37.374 |

Sell |

| STOCH(9,6) |

45.247 |

Neutral |

| STOCHRSI(14) |

87.392 |

Overbought |

| MACD(12,26) |

-0.016 |

Sell |

| ADX(14) |

46.413 |

Sell |

| Williams %R |

-66.32 |

Sell |

| CCI(14) |

-40.895 |

Neutral |

| ATR(14) |

0.0133 |

Less Volatility |

| Highs/Lows(14) |

0 |

Neutral |

| Ultimate Oscillator |

40.536 |

Sell |

| ROC |

-2.204 |

Sell |

| Bull/Bear Power(13) |

-0.01 |

Sell |

When it comes to emerging patterns, you can notice an inverted hammer forming. It suggests a short-term trend reversal. Such a formation happens when prices are almost back to their lowest points following a protracted sell-off.

)

What affects the CHF price?

The US dollar's and the Swiss franc's relative values to one another and other currencies have an impact on the USD/CHF exchange rate. Two major factors influencing the currency pair are employment data and the GDP of both nations.

This currency pair will also be impacted by the difference in interest rates between the Fed and the SNB. For instance, the value of the USD/CHF might rise as a result of the US dollar appreciating relative to the Swiss franc when the Fed engages in open market operations to boost the US currency.

However, if interest rates are raised by the Swiss National Bank, more investors may be drawn to the Franc, which would enhance its value. Since it will take less Francs to purchase one USD in this scenario, the USD/CHF exchange rate will decrease.

USD/CHF has a negative correlation with EUR/USD and GBP/USD because the British pound, the Euro, and the Swiss franc all have positive correlations.

How to predict the price of CHF

Aside from the above-mentioned signs of bearish or bullish trends (changes in banks’ interest rates and employment data), you should also consider other crucial factors. These include:

- Political stability in Switzerland and events in the EU can affect investor confidence and impact currency prices.

- Low inflation rates are generally associated with currency strength, as the purchasing power remains relatively stable.

- A positive trade balance (exports > imports) can contribute to a stronger currency because Switzerland is one of the major markets in international trade.

- Global risk sentiment is another driving point. The Swiss Franc is often considered a safe-haven currency. During times of global economic uncertainty or geopolitical tensions stocks are seen as unreluable assets, so investors may seek refuge in the CHF, leading to its appreciation.

Conclusion: Is CHF a good investment?

This question does not have an unambiguous answer, because everything depends on the time frame you consider. If you regard CHF as a trading instrument in your account, it might be a good idea to buy it for short and middle terms. If you want to invest in the long term, think twice – technical analyses made by AI suggest that the Dollar will regain its strong position during the upcoming years.

FAQ

What is the projection for CHF/USD?

The CHF/USD exchange rate is projected to range between 1.225 and 1.236 by the end of 2025, with continued strengthening expected through the forecast period as the Swiss Franc maintains its safe-haven appeal.

Is the CHF getting stronger?

Yes, the Swiss Franc (CHF) has been strengthening recently. Based on current forecasts for 2025, the USD/CHF exchange rate is expected to decline from 0.8120 at the end of 2025 to potentially 0.7450 in the 5-year outlook, indicating a stronger CHF against the USD.

Is USD/CHF a good pair to trade?

The USD/CHF currency pair, known as the "Swissie," is favored by traders for its liquidity and stability. Its status as a safe-haven asset makes it attractive during economic uncertainty. However, it's sensitive to geopolitical events, requiring traders to stay informed.