Global Wheat Price Prediction: Impacts of Economics and Climate

In 2025, agricultural markets remain volatile, driven by ongoing geopolitical tensions and the lasting effects of the pandemic. What should we expect from the wheat market now? This article offers a clear look at wheat prices in the US and beyond. You'll learn what shapes price forecasts, which countries lead in exports and imports, and what price levels are expected this year.

Table of Contents

Wheat Price Prediction Summary

A Detailed Glance at the US Market

What’s Driving Wheat Prices in 2025?

Wheat Price Predictions for 2025

Wheat Price Predictions for 2026

Wheat Price Predictions for 2027

Wheat Price Predictions for 2028

Wheat Price Predictions for 2029

Wheat Price Predictions for 2030

Conclusion

FAQ

Wheat Price Prediction Summary

Major Takeaways:

- Wheat prices are expected to show gradual growth from 2025 to 2030.

- Seasonal and geopolitical factors may influence monthly fluctuations.

- By 2030, average wheat prices could exceed $400 per bushel, based on Gov Capital data.

Wheat prices are projected to steadily rise over the next several years, driven by global demand, climate impacts, and economic trends. According to WalletInvestor forecasts, monthly averages suggest a moderate upward trend, with price ranges widening slightly due to market volatility.

The strongest price gains are anticipated between 2028 and 2030, aligning with broader agricultural inflation and supply chain challenges. This makes wheat a closely watched commodity for traders and analysts alike.

A Detailed Glance at the US Market

We will start with a detailed overview of the American domestic market, where wheat remains one of the most widely consumed commodities.

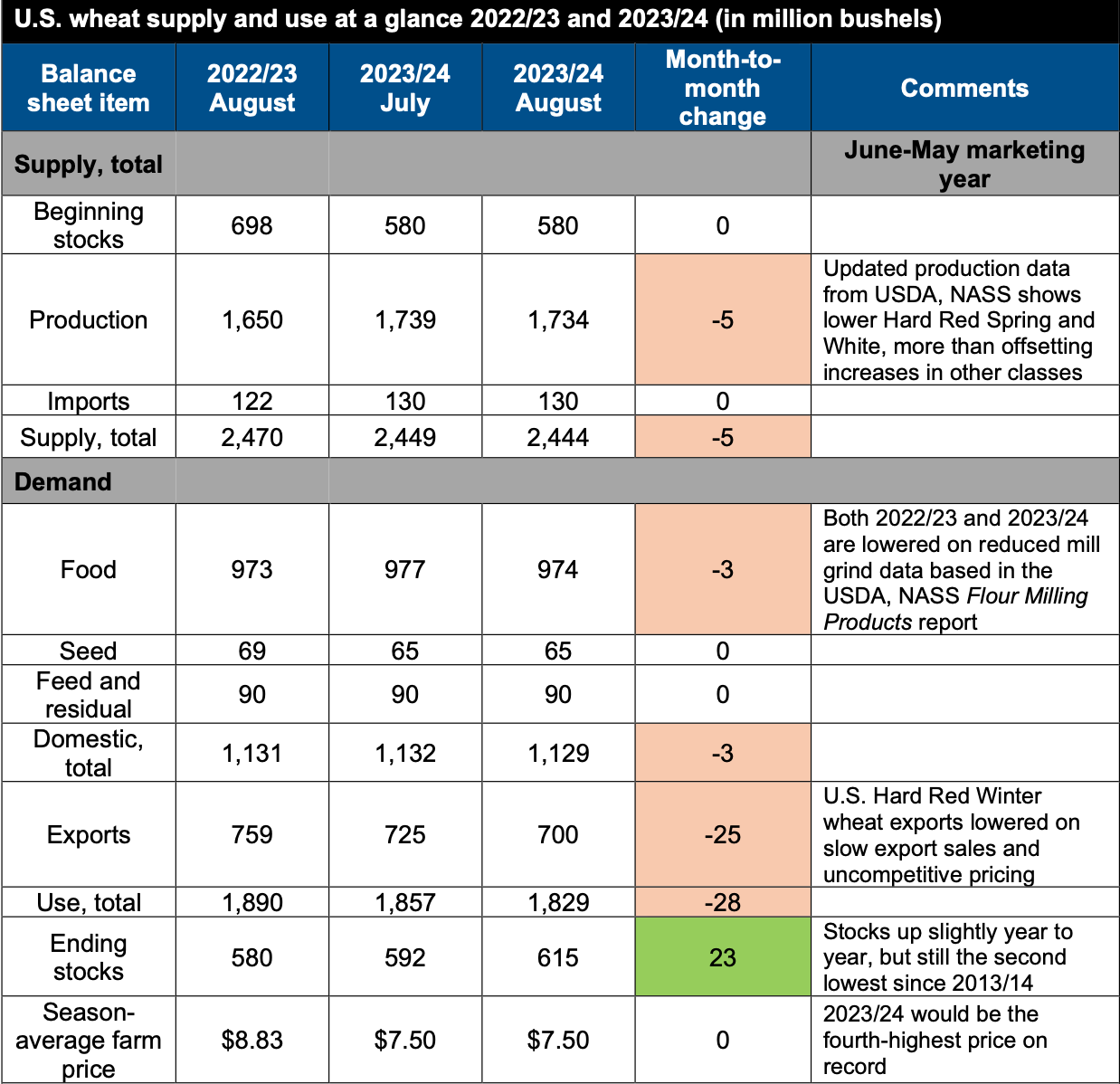

The US wheat output for the 2023–2024 marketing year is expected to be 1,734 million bushels, according to the USDA (National Agricultural Statistics Service’s crop output report). This is 5% higher than the previous year's prediction. However, there is a decrease of 5 million from the July estimate:

There is a 0.3 bushel reduction in the average all-wheat yield per acre, down to 45.8 bushels. The report included revised area planted and harvested based on certified acreage data from the USDA and Farm Service Agency (FSA), in addition to updated production numbers.

The average predicted yield of winter wheat is 48.1 bushels per acre, which is an increase of 1.2 bushels from the July prediction, and up from 47.0 bushels the previous year. The amount of winter wheat sown has been reduced to 36.8 million acres, and the amount harvested has also been reduced to 25.5 million acres.

Now, let’s view projections and predictions for different sorts of wheat according to the USDA and NASS:

- Hard Red Winter (HRW) output in the next marketing year to be 585 million bushels, an increase of 8 million above the July forecast. Although output of HRW has increased by 10% from the previous year, this season has seen greater abandonment rates and poorer yields than usual.

- Soft Red Winter (SRW) output for 2023–2024 is projected to reach 440 million bushels, up 18 million from the projection in July and 31% over the previous year due to increased yield and harvested area.

- White wheat output is expected to reach 239 million bushels, which is 6 million fewer than previously. The majority of this category, soft white winter wheat, is cultivated mostly in the Pacific Northwest and is projected to be lower this year than previous years due to somewhat drier growing conditions.

- Hard White Winter, Hard White Spring, and Soft White Spring, however, are all estimated to increase marginally from year to year.

Due to the poor rate of export sales, all-wheat exports from the United States are expected to total 700 million bushels in 2023–2024, a 25 million bushel decrease from the July prediction. Exports of HRW are now only 165 million bushels, down 25 million bushels.

The amount of wheat imported into the US in 2023–2024 remains at 130 million bushels. Ten million bushels of wheat were officially imported into the United States in June 2023. The season-average farm price for 2023–2024 remains at $7.50 per bushel.

What’s Driving Wheat Prices in 2025?

Wheat prices in 2025 are shaped by global trends, weather shocks, and shifting trade patterns. Let’s break down the most important factors behind this year's wheat price forecast.

Global Supply and Stock Levels

In the wheat market, everything starts with supply. And right now, there is no high demand. Global wheat production has struggled to keep up with growing demand, especially from developing countries. Lower yields in key regions, including the Black Sea, have caused a significant drop in available wheat. This is not just a number game, it’s about food security for millions.

Historical price data shows that when grain prices spike, it’s often tied to a sharp decline in global production. Add to that the rising energy costs and transportation hurdles, and the cost to move agricultural commodities shoots up. The current price of wheat reflects these real struggles, not just speculation.

Wheat exports from top producers are being monitored closely, as they can shift the balance fast. A surge or cut can send commodity prices, including corn prices and soybean prices, in new directions.

For an accurate wheat price forecast, analysts rely on technical analysis, historical price data, and future price movements in futures markets. But remember, this is not fortune-telling, it’s reading the room. And right now, the room is full of uncertainty.

Geopolitical Risks and Trade Disruptions

When politics gets heated, the agricultural market feels the burn. Ongoing conflicts in the Black Sea regions have already disrupted wheat shipments, shaking the nerves of major importers and traders. One blocked port, and suddenly commodity high prices swing like a barn door in the wind.

Wheat prices don’t live in a bubble. They move with the global economy, and in 2025, that economy is anything but stable. Trade disputes, sanctions, and shifting alliances keep everyone guessing. That’s why every solid wheat commodity forecast has to include a reality check on geopolitical tensions.

Countries with unstable trade routes are stocking up, while others wait it out. That back-and-forth causes major price fluctuations. Meanwhile, farmers face uncertainty about selling crops across borders or dealing with new tariffs.

To forecast wheat effectively, one must look beyond spreadsheets. It requires tracking political headlines and understanding how trade friction can flip the market overnight. The more unpredictable the politics, the harder it is to pin down a reliable forecast wheat outlook.

Weather and Climate Uncertainty

Let’s not ignore the wild card, weather conditions. Droughts, floods, and freak storms have hammered agricultural products around the globe. In 2025, erratic weather conditions have already hit major wheat-producing regions, impacting yields and tightening the supply chain.

Wheat price forecast models are starting to weigh in climate risk as a major factor, not a background detail. Long gone are the days when forecast wheat was just about crop calendars. Now, sudden snowfalls or prolonged heat waves can cause commodity prices to surge in days.

Extreme weather not only hurts wheat prices. It affects corn prices, soybean prices, and nearly all agricultural commodities. With shifting global demand, it creates effects throughout the agricultural market.

For traders and farmers (major exporters), this means doubling down on futures contracts and keeping an eye on real-time satellite data. The future price of wheat now depends as much on meteorology as on economics. Smart players use technical analysis and historical price information, but they also keep one eye on the sky.

Wheat Price Predictions for 2025

These projections suggest a predominantly bearish outlook for wheat prices in 2025, with occasional short-term recoveries. Market participants should monitor global supply-demand dynamics and geopolitical factors that could influence price movements.

| Month |

Open ($) per unit |

Close ($) per unit |

| July | $516.57 | $516.06 |

| August | $515.80 | $488.58 |

| September | $487.64 | $503.32 |

| October | $504.21 | $503.23 |

| November | $502.65 | $492.19 |

| December | $491.56 | $489.20 |

Note: These forecasts are based on current market analyses and are subject to change with global economic and environmental factors.

Wheat Price Predictions for 2026

Wheat prices in 2026 are projected to remain stable, influenced by global supply dynamics and geopolitical factors. Consulting with multiple sources will help you make more informed decisions.

| Month |

Open ($) per unit |

Close ($) per unit |

| January | 704.50 | 705.31 |

| February | 707.27 | 734.93 |

| March | 743.27 | 751.82 |

| April | 751.75 | 758.75 |

| May | 758.76 | 768.94 |

| June | 769.03 | 743.02 |

| July | 743.67 | 754.57 |

| August | 756.07 | 758.30 |

| September | 756.51 | 743.71 |

Note: These forecasts are based on current market analyses and are subject to change with global economic and environmental factors.

Wheat Price Predictions for 2027

These forecasts reflect varying methodologies and market analyses, highlighting the importance of considering multiple sources when evaluating future wheat price movements to help you make informed decisions.

| Month |

Open ($) per unit |

Close ($) per unit |

| July | 803.61 | 814.35 |

| August | 815.89 | 816.92 |

| September | 817.22 | 803.59 |

| October | 803.75 | 811.90 |

| November | 812.85 | 811.99 |

| December | 812.77 | 824.77 |

Wheat Price Predictions for 2028

Wheat prices in 2028 are expected to remain relatively stable, influenced by global supply dynamics and geopolitical factors.

| Month |

Open ($) per bushel |

Close ($) per bushel |

| May | 879.88 | 888.43 |

| June | 887.88 | 863.45 |

| July | 864.94 | 875.70 |

| August | 874.40 | 877.25 |

| September | 876.74 | 863.38 |

| October | 865.47 | 871.40 |

| November | 872.00 | 872.67 |

| December | 872.72 | 885.03 |

Note: These forecasts are based on current market analyses and are subject to change with global economic and environmental factors.

Wheat Price Predictions for 2029

These forecasts are based on current market analyses and are subject to change with global economic and environmental factors.

| Month |

Open ($) per bushel |

Close ($) per bushel |

| January | 885.32 | 885.92 |

| February | 886.17 | 888.57 |

| March | 889.00 | 890.50 |

| April | 891.00 | 892.75 |

| May | 893.00 | 894.25 |

| June | 895.00 | 896.50 |

| July | 897.00 | 898.75 |

| August | 899.00 | 900.50 |

| September | 901.00 | 902.25 |

| October | 903.00 | 904.75 |

| November | 905.00 | 906.50 |

| December | 907.00 | 908.75 |

Wheat Price Predictions for 2030

In 2030, wheat prices are projected to experience moderate fluctuations, influenced by global supply dynamics and market conditions.

| Month |

Average ($) per bushel |

| January | 404.55 |

| February | 407.97 |

| March | 402.22 |

| April | 435.13 |

Conclusion

As one of the most demanded commodities around the world, and yet depending on yields, wheat is a pretty volatile asset. While exports and imports were at their highest during pre-Covid times, 2021–2023 was a pretty hard period for many countries. Geopolitical instability and dry weather conditions impacted its production and transportation. In the coming years, we can expect the price of wheat to reach a maximum of 670 dollars per bushel, which is conditioned by growing demand. Wheat stocks and wheat futures will grow correspondingly.

FAQ

What is the wheat outlook for 2025?

In the early months of 2025, wheat reached over $500 per bushel. The wheat outlook for 2025 suggests relatively stable market conditions, with moderate price movements expected due to balanced global supply and demand. Weather patterns and trade dynamics may still influence short-term trends.

What are the predictions for wheat prices?

Factors such as weather conditions, trade policies, and geopolitical events may cause short-term fluctuations, but overall, the market is projected to experience moderate movements. Analysts suggest that while prices may not see significant spikes, they are unlikely to drop drastically, maintaining a steady trend throughout the year due to strong demand.

What is the future projection for wheat?

Wheat prices are expected to follow a moderate upward trend due to growing global consumption, climate-related disruptions, and shifting trade patterns. Long-term projections highlight the importance of supply chain resilience and innovation in agriculture.