Tesla (TSLA) Stock Forecast & Price Prediction

Tesla, one of the world’s most notable automobile brands, is a bone of contention between bears and bulls. Today, the company’s market cap is $1.351 trillion, which is more than many other competitors have. In this guide, we will take a look at TSLA stock price performance, what forms its cost, and how it will be impacted by market sentiments, changes within the company, and competitors’ products.

Table of Contents

Key Takeaways

Short-term Tesla Price Forecast for 2025

Tesla Forecast for 2026

Tesla Forecast for 2027

Tesla Forecast for 2028

Tesla Forecast for 2029

Tesla Forecast for 2030

Tesla Technical Analysis

About Tesla (TSLA) Stock Rate Forecast

What Affects Tesla Stock Price

How to Predict the Tesla Stock Price

Conclusion

FAQs

Key Takeaways

-

In 2025 Tesla stock prices are estimated to range from $316.83 to $1,198.56, with strong sales and market momentum driving potential gains.

- For 2026-2030 term, Projected prices peak at $3,601.58 by 2029, reflecting TSLA’s upside potential as market capitalization grows. Notable price targets include $2,738.40 in 2028 and $3,486.56 in 2029.

- Tesla stock remains a dynamic opportunity for traders and investors, with strong buy ratings supported by bullish technical analysis.

| Year |

Average Price ($) |

| 2025 |

$586.97 |

| 2026 |

$600.88 |

| 2027 |

$426.44 |

| 2028 |

$509.20 |

| 2029 |

$2,615.33 |

| 2030 |

$2,624.18 |

Short-term Tesla price forecast for 2025

Tesla's stock (TSLA) price forecast for 2025 presents an intriguing investment opportunity, highlighting significant potential for returns, especially in the latter months of the year. According to CoinCodex projections, TSLA stocks show that potential ROI will exceed 184% in November and 161% in October.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$538.11 |

$675.04 |

$738.14 |

75.30% |

| February |

$456.08 |

$590.32 |

$711.81 |

69.05% |

| March |

$345.10 |

$433.06 |

$491.41 |

16.71% |

| April |

$469.24 |

$511.99 |

$565.32 |

34.26% |

| May |

$316.83 |

$383.36 |

$463.96 |

10.19% |

| June |

$350.23 |

$406.63 |

$477.87 |

13.49% |

| July |

$417.92 |

$446.73 |

$512.65 |

21.75% |

| August |

$457.60 |

$506.23 |

$545.88 |

29.64% |

| September |

$537.79 |

$568.85 |

$608.93 |

44.62% |

| October |

$601.39 |

$749.58 |

$1,102.74 |

161.90% |

| November |

$916.10 |

$1,053.52 |

$1,198.56 |

184.65% |

| December |

$781.06 |

$915.59 |

$1,061.46 |

152.09% |

January 2025

Tesla's stock shows strong potential, with an average price of $675.04 and a potential ROI of 75.30%. This month represents a solid start with robust investor confidence.

February 2025

Average and maximum prices may decline slightly in February compared to January, with an ROI of 69.05%. The market may exhibit cautious optimism amid volatility.

March 2025

March is expected to come with a significant drop in prices and ROI to 16.71%. This indicates a bearish trend, suggesting potential market corrections or reduced investor enthusiasm.

April 2025

A recovery phase in the Tesla market is expected in April, with average prices improving to $511.99 and ROI rising to 34.26%. Positive momentum begins to return to the stock.

May 2025

Another decline may happen in May, with ROI dropping to 10.19% and the average price at $383.36. Uncertainty prevails, reflecting a need for cautious short-term strategies.

June 2025

A slight uptick in prices and ROI is expected in June, signaling stabilization but still limited growth. Investors may remain on edge.

July 2025

Experts predict moderate recovery with an ROI of 21.75% and a small rise in prices. The stock shows resilience, regaining some market confidence.

August 2025

A steady upward trend with average prices reaching $506.23 and ROI increasing to 29.64% is expected. The market sentiment appears more optimistic.

September 2025

This month is to stand out with a stronger performance. TSLA prices will continue to rise and ROI is expected to reach 44.62%. This marks a period of sustained growth.

October 2025

Analysts forecast a significant surge in the value of Tesla stock, with a maximum price over $1,100. Investor enthusiasm peaks, likely driven by major positive developments or announcements.

November 2025

The rally continues with ROI hitting 184.65%, the highest in the forecast. Tesla's stock is at a peak, reflecting heightened market excitement and robust performance.

December 2025

A slight pullback from November's highs may happen, but ROI remains strong at 152.09%. This suggests consolidation with the stock maintaining substantial value.

Tesla Forecast for 2026

Tesla Inc.'s TSLA stock forecast for 2026 outlines a wide price range. Analysts' average price target represents significant volatility. Estimates project a high of $1,117.03 in January and a downside to $18.63 in December.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$691.76 |

$907.30 |

$1,117.03 |

165.29% |

| February |

$586.03 |

$731.65 |

$804.34 |

91.03% |

| March |

$605.00 |

$780.32 |

$1,025.24 |

143.49% |

| April |

$726.15 |

$900.07 |

$1,054.13 |

150.35% |

| May |

$417.10 |

$580.51 |

$784.88 |

86.41% |

| June |

$435.65 |

$502.21 |

$577.54 |

37.16% |

| July |

$466.60 |

$583.21 |

$773.38 |

83.67% |

| August |

$662.82 |

$745.30 |

$795.89 |

89.02% |

| September |

$639.29 |

$720.33 |

$798.61 |

89.67% |

| October |

$392.75 |

$463.18 |

$594.90 |

41.29% |

| November |

$245.62 |

$332.76 |

$489.75 |

16.31% |

| December |

$18.63 |

$187.31 |

$344.16 |

18.26% |

Tesla Forecast for 2027

Tesla's TSLA stock forecast for 2027 highlights calculated market opportunities, with potential upsides like a high of $733.46 in July and an average of $562.03 in June, reflecting a 74.19% ROI. Despite the high risk, technical analysis suggests strategic positioning for growth, especially as TSLA's market capitalization develops on Nasdaq.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$0.150788 |

$113.52 |

$313.69 |

25.50% |

| February |

$325.19 |

$365.25 |

$408.12 |

3.07% |

| March |

$248.13 |

$316.12 |

$371.14 |

11.86% |

| April |

$191.97 |

$268.00 |

$361.97 |

14.03% |

| May |

$213.18 |

$278.76 |

$400.00 |

5.00% |

| June |

$421.10 |

$562.03 |

$682.50 |

62.09% |

| July |

$587.76 |

$651.77 |

$733.46 |

74.19% |

| August |

$432.01 |

$526.59 |

$598.30 |

42.09% |

| September |

$523.03 |

$592.03 |

$662.04 |

57.23% |

| October |

$361.33 |

$507.61 |

$626.41 |

48.77% |

| November |

$400.41 |

$482.97 |

$550.76 |

30.80% |

| December |

$502.51 |

$555.28 |

$605.28 |

43.75% |

Tesla Forecast for 2028

Tesla stock forecast for 2028 presents exceptional upside potential, with December's average price projected at $1,799.37 and a maximum of $2,738.40.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$301.83 |

$410.88 |

$523.77 |

24.39% |

| February |

$284.82 |

$337.66 |

$372.59 |

11.51% |

| March |

$219.77 |

$259.04 |

$294.17 |

30.14% |

| April |

$134.33 |

$232.34 |

$322.17 |

23.49% |

| May |

$249.91 |

$273.02 |

$298.71 |

29.06% |

| June |

$243.76 |

$322.05 |

$535.88 |

27.27% |

| July |

$375.35 |

$525.90 |

$610.97 |

45.10% |

| August |

$350.90 |

$401.12 |

$455.74 |

8.24% |

| September |

$438.67 |

$517.61 |

$603.60 |

43.35% |

| October |

$429.80 |

$516.55 |

$633.82 |

50.53% |

| November |

$549.62 |

$853.83 |

$982.37 |

133.31% |

| December |

$971.97 |

$1,799.37 |

$2,738.40 |

550.36% |

Tesla Forecast for 2029

The 2029 TSLA stock forecast highlights strong bullish potential, with December's average price at $3,298.81 and a maximum of $3,486.56, reflecting a 728.04% growth. Investors should prioritize risk management given the inherent uncertainty of long-term forecasts.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$2,777.48 |

$2,957.00 |

$3,035.91 |

621.02% |

| February |

$2,489.21 |

$2,782.94 |

$2,996.61 |

611.68% |

| March |

$2,449.11 |

$2,589.38 |

$2,667.56 |

533.53% |

| April |

$2,626.42 |

$2,695.94 |

$2,777.90 |

559.74% |

| May |

$2,406.92 |

$2,495.39 |

$2,623.23 |

523.01% |

| June |

$2,466.63 |

$2,552.91 |

$2,650.21 |

529.41% |

| July |

$2,557.83 |

$2,605.28 |

$2,708.72 |

543.31% |

| August |

$2,617.08 |

$2,692.13 |

$2,748.87 |

552.84% |

| September |

$2,736.79 |

$2,789.83 |

$2,856.16 |

578.33% |

| October |

$2,839.00 |

$3,103.11 |

$3,629.70 |

762.04% |

| November |

$3,301.60 |

$3,497.32 |

$3,723.30 |

784.27% |

| December |

$3,099.99 |

$3,298.81 |

$3,486.56 |

728.04% |

Tesla Forecast for 2030

Tesla stock forecast for 2029 projects a price range from a low of $1,951.42 in December to a high of $3,601.58 in January, with average prices showing a slight decline through the year. Analysts highlight strong buy ratings early in the year, where trading opportunities align with peak prices.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January |

$2,966.67 |

$3,261.31 |

$3,601.58 |

755.36% |

| February |

$2,808.82 |

$3,019.01 |

$3,134.75 |

644.49% |

| March |

$2,837.14 |

$3,127.97 |

$3,464.54 |

722.81% |

| April |

$3,018.01 |

$3,252.46 |

$3,507.67 |

733.06% |

| May |

$2,556.62 |

$2,782.48 |

$3,105.70 |

637.59% |

| June |

$2,584.30 |

$2,673.10 |

$2,751.82 |

553.54% |

| July |

$2,652.41 |

$2,835.20 |

$3,113.90 |

639.54% |

| August |

$2,905.75 |

$3,034.13 |

$3,122.13 |

641.49% |

| September |

$2,785.77 |

$3,002.09 |

$3,126.19 |

642.46% |

| October |

$2,520.25 |

$2,615.01 |

$2,765.73 |

556.85% |

| November |

$2,300.59 |

$2,417.45 |

$2,596.25 |

516.60% |

| December |

$1,951.42 |

$2,181.95 |

$2,436.63 |

478.69% |

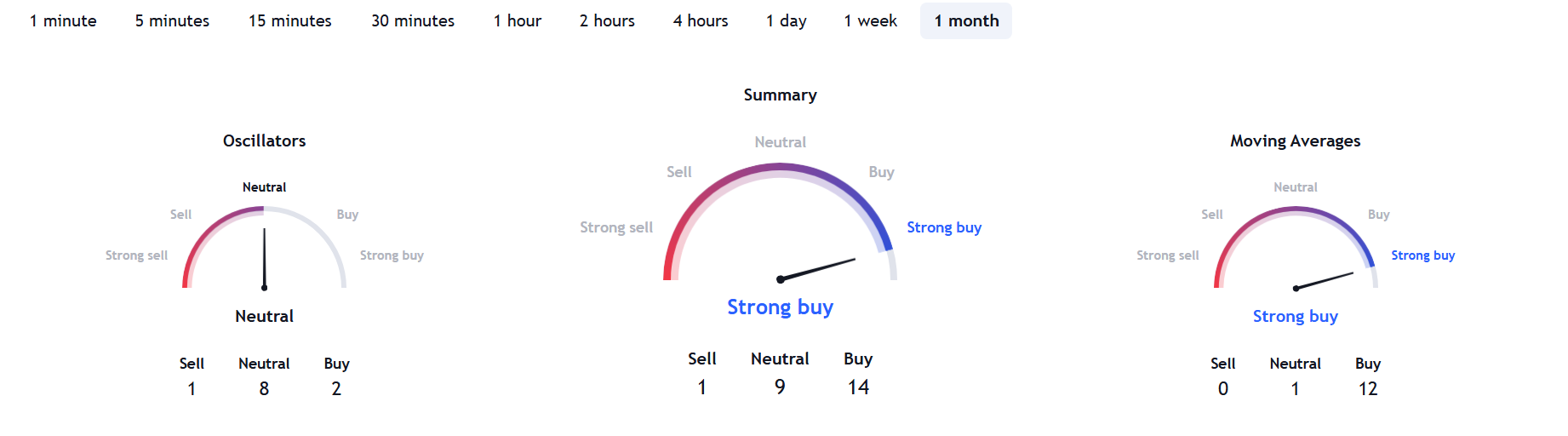

Tesla technical analysis

Tesla's technical analysis on the monthly chart highlights bullish momentum, with moving averages signaling upward trends and oscillators showing a neutral stance. The overall signal is a strong buy, reflecting confidence in TSLA's continued growth potential. This setup positions Tesla stock as an attractive opportunity for both short- and long-term traders.

| Name |

Value |

Action |

| Relative Strength Index (14) |

69.48 |

Neutral |

| Stochastic %K (14, 3, 3) |

84.14 |

Neutral |

| Exponential Moving Average (30) |

239.57 |

Buy |

| Simple Moving Average (30) |

230.43 |

Buy |

| Exponential Moving Average (50) |

216.75 |

Buy |

| Simple Moving Average (50) |

245.77 |

Buy |

| Exponential Moving Average (100) |

164.21 |

Buy |

| Simple Moving Average (100) |

139.03 |

Buy |

About Tesla (TSLA) stock rate forecast

Tesla (TSLA) stock forecast for 2025 suggests significant growth, with estimates highlighting a price range of $316.83 to $1,198.56. The chart indicates strong sales potential, positioning TSLA as a leading stock in the EV market. Strategic investments could capitalize on this range for profitable sales.

What Affects Tesla stock price

Here are the main market events that can push TSLA price up or influence it to go downward.

-

Earnings Reports, such as Tesla's quarterly performance and sales figures.

- Market trends, such as changes in EV demand and industry competition.

- Regulations, for example, government policies on clean energy and subsidies.

- Innovation, including product launches and technological advancements.

How to predict the Tesla stock price

To predict Tesla's stock price, focus on key factors:

-

Analyze financial performance, market trends, and industry demand.

- Monitor macroeconomic indicators, global EV sales, and regulatory changes.

- Evaluate technical charts, moving averages, and trading volumes for insight into future movements.

Conclusion

In conclusion, the Tesla stock forecast for 2025-2030 highlights substantial growth potential, with peak prices projected in later years. Analysts indicate strong buy ratings supported by bullish technical trends and sales performance. While Tesla offers significant upside, risk management and careful trading strategies are essential due to forecast uncertainties.

FAQs

How high is Tesla stock expected to go?

Tesla stock is forecasted to reach up to $3,601.58 by 2029, with analysts highlighting TSLA’s upside potential based on market trends and strong sales performance.

What is the 5 year forecast for Tesla stock?

The 5-year Tesla stock forecast predicts a price range between $538.11 (2025) and $3,601.58 (2029), driven by market development, strong sales, and growing market capitalization.

Is a Tesla a buy or sell?

Currently, analysts rate Tesla stock as a strong buy due to bullish technical signals, high average price targets, and projected growth in sales and market position on Nasdaq.

What is the forecast for Tesla in 2025?

In 2025, Tesla stock is expected to trade between $316.83 and $1,198.56, with analysts average price target reflecting strong growth potential and favorable sales data.

)