Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Investors looking for a viable option in the portfolio in regards to growth and value may want to consider Fox Corporation's FOXA stock which lands a Zacks Rank #1 (Strong Buy) and the Bull of the Day.

As one of the premier media companies, now appears to be an ideal time to invest in Fox’s presence as a news, sports, and entertainment content provider.

To that point, the rally in Fox’s stock looks likely to continue with FOXA soaring over +50% in the last year.

Notably, this has impressively topped the broader indexes and has crushed the performances of many of its closest competitors such as Disney DIS, the owner of ABC, and Comcast CMCSA which owns NBC.

Image Source: Zacks Investment Research

Fox has reportedly sold all of its advertising slots as the primary broadcaster of the upcoming Super Bowl LIX in February. More intriguing, some brands are whispered to be paying up to a record $7 million for a 30-second advertising commercial.

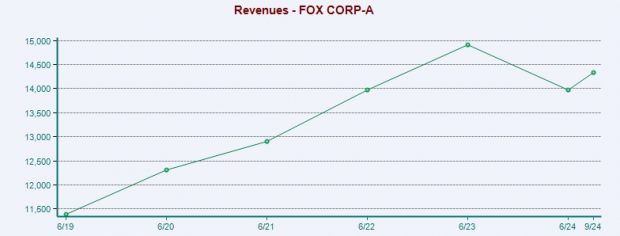

The last time Fox had Super Bowl rights was in 2023 when the company generated $600 million in advertising revenue. Considering the massive boost in viewership that a Super Bowl can bring to a network, Fox’s total sales are expected to spike 12% in fiscal 2025 to what would be a record $15.63 billion versus $13.98 billion last year.

Although FY26 sales are projected to dip -2%, projections of $15.3 billion would still refect 18% growth in the last five years and be above Fox's previous record of $14.9 billion in total sales in 2023 (Super Bowl Year).

Image Source: Zacks Investment Research

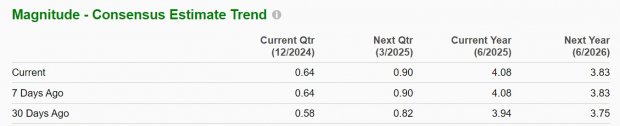

Most Importantly, in regards to profitability, Fox’s annual earnings are now expected to climb 19% in FY25 to a record $4.08 per share compared to EPS of $3.43 in 2024. Reassuringly, FY25 EPS estimates have risen over 3% in the last 30 days.

Furthermore, while FY26 EPS is projected to dip to $3.83, it’s noteworthy that estimates are up 2% in the last month.

Image Source: Zacks Investment Research

Making the positive EPS revisions more appealing is that at just under $50 a share, FOXA still trades at a very reasonable 11.8X forward earnings multiple.

Trading at a sharp discount to the benchmark S&P 500’s forward P/E valuation and its Zacks Broadcast Radio and Television Industry average, FOXA also trades beneath Disney’s 20X and is near Comcast’s 8.2X.

Image Source: Zacks Investment Research

As the delegated network for the upcoming Super Bowl, Fox’s stock is hard to overlook at the moment and in addition to its strong buy rating has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fox Corporation (FOXA) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.