Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

If you didn’t know how banks made money, you would be justified in assuming that their business must be really exposed to tariffs. That will be a logical interpretation of bank stock performance in the ongoing tariff-induced market turmoil.

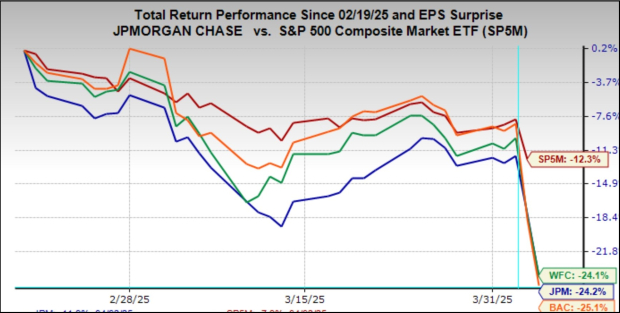

The chart below shows the performance of JPMorgan JPM, Wells Fargo WFC, Bank of America BAC, and Morgan Stanely MS relative to the S&P 500 index since February 19th. Two of these three banks are on deck to kick off the 2025 Q1 reporting cycle for the Finance sector by reporting their results before the market’s open on Friday, April 11th.

We all know that the banking business isn’t subject to tariffs. But as cyclical operators, their business is heavily exposed to trends in the broader economy, which in turn is seen as weighed down by the ongoing tariffs uncertainty.

There is no denying that risks to the broader economic outlook have increased, with many economists raising their recession odds and lowering their GDP growth expectations. Simply looking at the chart above, which shows the performance of these bank stocks since February 19th, makes it clear that market participants see the going getting more challenging for these banks.

We intuitively understand this as the demand for credit decreases in a softening economic environment. At the same time, the quality of the bank’s assets suffers, as a portion of its existing borrowers are unable to pay back their loans.

Monthly loan volume data from the Federal Reserve has been showing a modest acceleration in loan demand in the first three months of the year, with commercial and industrial (C&I) loans and home-equity loans modestly up. The overriding issue for bank stock investors, however, is whether these trends can be sustained in the current macroeconomic environment. The stock market performance of these bank stocks suggests that they aren’t hopeful on that count.

With respect to credit quality, the problems in the commercial real estate (CRE) market are well-known and already adequately provisioned for at the major banks. Beyond CRE, aggregate bankruptcies in the U.S. have risen significantly from the Covid-driven low of early 2022, but the growth rate has been leveling off in recent months. We see this trend in early-stage credit card delinquencies as well, with the flat year-over-year growth rates in recent months indicative of favorable developments with respect to net charge-off rates this year.

As with loan demand, the key question on the credit quality front will be expectations for the coming periods in a macroeconomic backdrop that is at best showing moderating growth, if not an altogether recessionary downturn.

The outlook for the investment banking business is likely the biggest victim of the deterioration in market sentiment. This is notable, as management teams have consistently flagged the steady expansion in deal pipelines in recent quarters. At the start of the year, many in the market had been expecting to see signs of the hoped-for rebound in these Q1 results, but that has now been delayed, at least while the tariffs issue is front and center for the market.

JPMorgan is expected to report $4.60 per share in earnings (down -0.7% year-over-year) on $43.01 billion in revenues (up +2.6% YoY). The stock was up nicely on the last earnings release on January 15th, reflecting positive commentary about the outlook. Estimates have been steadily going up, with the current $4.60 per share estimate up from $4.54 a month ago and $4.25 three months back.

Wells Fargo is expected to report EPS of $1.23 (down -2.4% year-over-year) on $20.8 billion in revenues (down -0.3% YOY). Estimates for Q1 have largely been stable since the quarter got underway, with the current $1.23 estimate down from $1.24 a month back but up from $1.19 per share three months back. Wells Fargo were shares up following the last quarterly release on January 15th.

For Morgan Stanely, the expectation is of $2.32 per share in earnings (up +14.9% YOY) on $16.8 billion in revenues (up +11.2%). The revisions trend has been positive, with analysts nudging their estimates higher since the quarter got underway. As with JPMorgan and Wells Fargo, Morgan Stanley shares were also up following the last quarterly release.

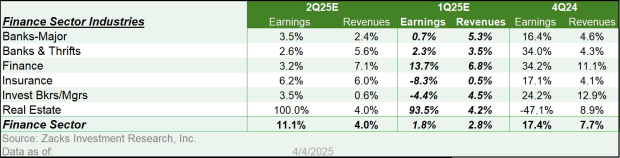

The Zacks Major Banks industry, of which JPMorgan and Wells Fargo are a part, is expected to earn +0.7% higher earnings in 2025 Q1 on +5.3% higher revenues. Please note that this industry brought in roughly 50% of the Zacks Finance sector’s total earnings over the trailing four-quarter period.

As you can see above, Q1 earnings for the Zacks Finance sector are expected to be up +1.8% from the same period last year on +2.8% higher revenues.

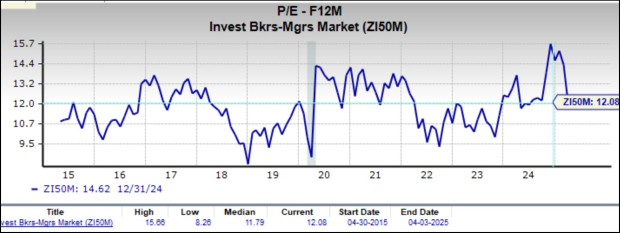

Despite the big bank stocks’ outperformance over the past year, they are still cheap on most conventional valuation metrics. The chart below shows a 10-year history of the Zacks Major Banks industry for a forward 12-month P/E basis.

Relative to the S&P 500 index, the Zacks Major Banks industry is currently trading at 61% of the S&P 500 forward 12-month P/E multiple. Over the last 10 years, the industry has traded as high as 78% of the index, as low as 52%, and median of 62%, as the chart below shows.

Early Q1 Earnings Scorecard

The Q1 reporting cycle will really get going this week with the aforementioned bank results. But several companies with fiscal quarters ending in February have been reporting results in recent weeks. Thus far, we have seen such February-quarter results from 19 S&P 500 members. All of these February-quarter results are combined with our March-quarter results.

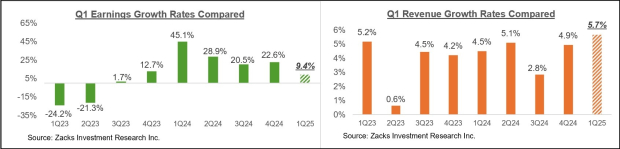

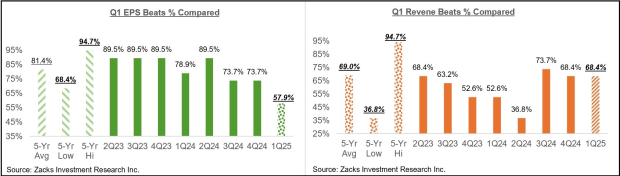

Total earnings for these 19 index members are up +9.4% from the same period last year on +5.7% revenue gains, with 57.9% of the companies beating EPS estimates and 68.4% beating revenue estimates.

The comparison charts below put the Q1 earnings and revenue growth rates for these index members in a historical context.

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

As you can see here, these early companies appear to be struggling to beat consensus estimates, with the EPS beats percentage for this group of companies the lowest in the preceding 20-quarter period. This is disconcerting, but we want to caution against reading too much into these early results, given the sample size.

Q1 Earnings Estimates Under Pressure

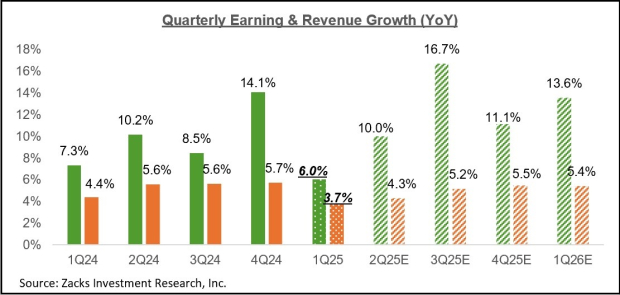

The expectation is that Q1 earnings will be up +6% from the same period last year on +3.7% higher revenues, which would follow the +14.1% earnings growth on +5.7% revenue gains in the preceding period.

The chart below shows current earnings and revenue growth expectations for 2025 Q1 in the context of where growth has been over the preceding four quarters and what is currently expected for the following four quarters.

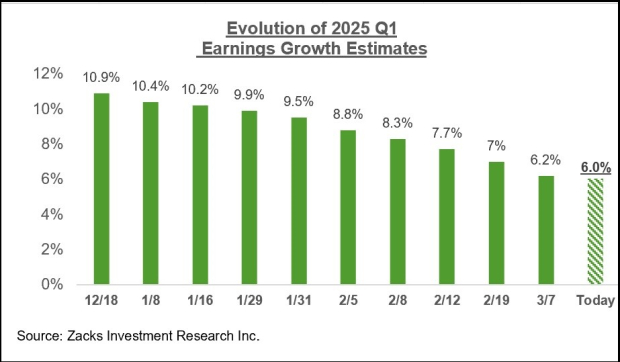

We have been experiencing a relatively high magnitude of negative revisions to estimates for the current period (2025 Q1), even before the more recent signs of weakness in data that drove the recent run of soft guidance from several companies.

The chart below shows how Q1 earnings growth expectations have evolved since the quarter got underway.

As noted earlier, these are more negative revisions to Q1 estimates since the start of January compared to the comparable periods of the preceding few quarters. Not only is the magnitude of negative revisions to Q1 estimates more pronounced relative to the last few quarters, but it is also more widespread.

Since the start of the period in January, estimates have come down for 13 of the 16 Zacks sectors, with the biggest declines for the Conglomerates, Autos, Basic Materials, Aerospace, Consumer Discretionary, and others.

The three sectors whose Q1 estimates have moved up since the quarter got underway are Medical, Utilities, and Construction.

The Tech sector, whose estimates have consistently been positive over the past year, is also suffering negative revisions to Q1 estimates. Optimism about the AI investment cycle suffered a psychological blow following China’s DeepSeek announcement. The resulting shift in market sentiment has been weighing on the space ever since, contributing to the underperformance of AI-focused stocks this year. Tariff headwinds add to the sector's worries, as a large portion of Tech hardware is manufactured in Asia.

The sector still remains a key growth driver in Q1 and beyond, with 2025 Q1 earnings for the Tech sector expected to be up +12.6% on +10.2% higher revenues. A lot will be riding on the evolving earnings expectations for the Tech sector, which has been a pillar of growth over the last two years.

The recent run of underwhelming guidance releases are coming at a time of growing anxiety about the macroeconomic backdrop, with many in the market starting to worry about the U.S. economy’s near-term growth momentum. Uncertainty about the Trump administration’s tariff policies is starting to appear in business and consumer confidence measures, and some have begun to worry that the ongoing public sector job cuts will eventually spill over into the private sector as well.

Depending on where the emerging tariff regime settles, earnings estimates will need to come down in response. The ongoing market weakness is essentially a reflection of this diminished earnings expectations.

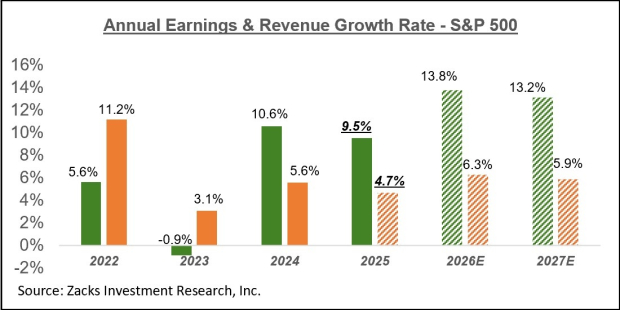

The chart below shows the overall earnings picture on a calendar-year basis, with a strong growth momentum expected through 2027.

For more details about the evolving earnings picture, please check out our weekly Earnings Trends report here >>>> Looking Ahead to the Q1 Earnings Season

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.