Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

With a market cap of $51.5 billion, The Allstate Corporation (ALL) provides property and casualty, and other insurance products. Headquartered in Northbrook, Illinois, the company operates in five segments: Allstate Protection; Run-off Property-Liability; Protection Services; Allstate Health and Benefits; and Corporate and Other.

The insurance company is expected to release its Q1 2025 earnings after the market closes on Wednesday, Apr. 30. Ahead of this event, analysts project ALL to report an adjusted profit of $3.76 per share, down 26.7% from $5.13 per share in the year-ago quarter. However, the company has surpassed Wall Street’s bottom-line expectations in the past four quarters.

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

For fiscal 2025, analysts forecast Allstate to report an adjusted EPS of $18.19, a marginal decline from $18.32 in fiscal 2024. Nevertheless, in fiscal 2026, its earnings are expected to surge 19.5% year-over-year to $21.73 per share.

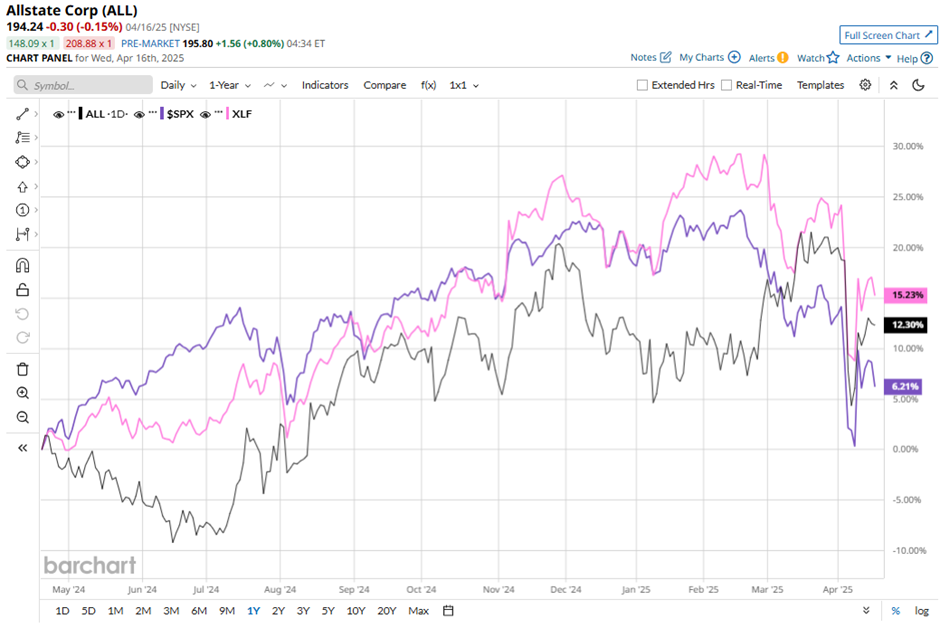

ALL stock has gained nearly 18.3% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 4.4% rise and the Financial Select Sector SPDR Fund’s (XLF) 17.5% return during the same time frame.

Shares of Allstate dropped marginally the following day after it released its Q4 2024 results on Feb. 5. The company reported revenue of $16.5 billion, reflecting an increase of 11.3% year-over-year. Driven by a strategic shift to higher-yielding fixed income securities, portfolio expansion, and improved performance-based returns, its Investment income rose to $3.1 billion in 2024, a 24.8% increase from the prior year. ALL also delivered a robust EPS of $7.67, marking a 31.8% increase from last year and topping consensus estimates.

Analysts' consensus view on ALL stock is moderately optimistic, with a "Moderate Buy" rating overall. Out of 21 analysts covering the stock, opinions include 16 "Strong Buys," one "Moderate Buy," two “Holds,” and two “Strong Sells”. The mean price target of $225.06 suggests a 15.9% upside potential from current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.