Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

Uncertainty about the overall macroeconomic picture continues to be a significant drag on the earnings outlook as a whole, prompting analysts to cut their estimates for the current and coming periods.

This uncertain environment makes it difficult for companies to provide explicit guidance for the coming periods. We had noted here how United Air Lines UAL had provided a two-pronged outlook, with one guidance a reiteration of their existing outlook and the second describing the earnings impact of a recessionary backdrop.

Since then, 3M MMM followed United Air Lines’ lead by reiterating its outlook for the year, but also gave a tariffs component that will potentially weigh on full-year EPS in the -2.5% to -5% range.

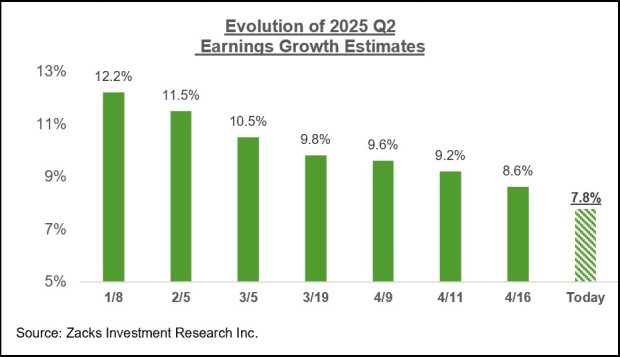

We are starting to see this in the revisions trend, both for the current period (2025 Q2) and full-year 2025. The chart below shows how 2025 Q2 estimates have started coming down lately.

Image Source: Zacks Investment Research

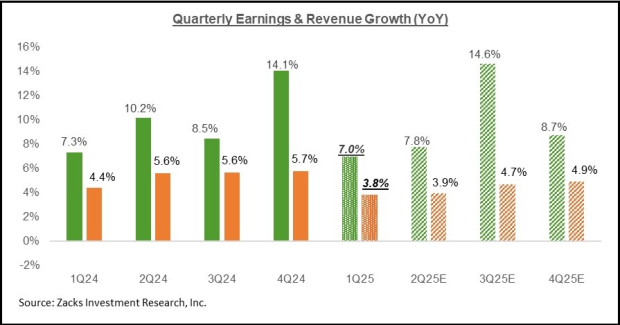

The chart below shows expectations for 2025 Q1 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

The emerging negative revisions trend appears to be broad-based, with Aerospace and Construction as the only sectors experiencing modest positive revisions.

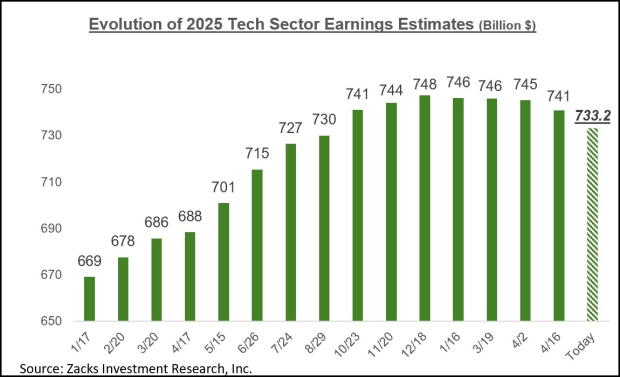

Of the sectors suffering negative estimate revisions, the case of the Tech sector is particularly significant as this sector had thus far been enjoying a very favorable revisions trend for more than a year now.

For 2025 Q2, the Tech sector is currently expected to bring in +11.5% more earnings relative to the same period last year. This growth expectation is down from +14.2% on April 2nd. For full-year 2025, the expectation is for sector earnings to increase +10.2% from the 2024 level, a decline from the +12.1% growth expected on April 2nd.

The chart below shows how full-year 2025 aggregate earnings expectations for the sector have evolved over time.

Image Source: Zacks Investment Research

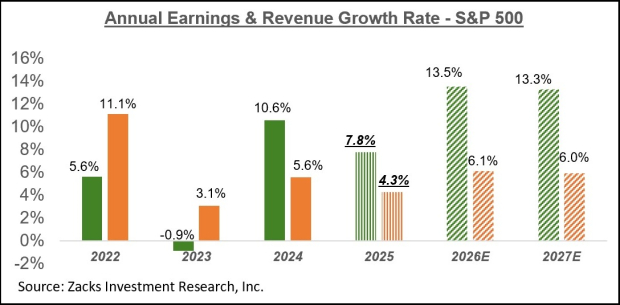

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

While estimates for this year have started coming down lately, there haven’t been a lot of changes to estimates for the next two years at this stage. It is reasonable to expect these estimates to be adjusted downward as the effects of slowing U.S. economic growth and tariffs begin to be reflected in diminished corporate profitability.

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.