Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Deere & Company DE reported second-quarter fiscal 2025 (ended April 27) earnings of $6.64 per share, beating the Zacks Consensus Estimate of $5.68. The bottom line decreased 22% from the prior-year quarter on lower shipment volumes.

Net sales of equipment operations (comprising Agriculture, and Turf, Construction and Forestry) were $11.17 billion, down 17.9% year over year. However, net sales topped the Zacks Consensus Estimate of $10.65 billion. Total net sales (including financial services and others) were $12.76 billion, down 16% year over year.

Deere & Company price-consensus-eps-surprise-chart | Deere & Company Quote

The cost of sales in the reported quarter was down 16.9% year over year to $7.61 billion. Total gross profit decreased 20.1% year over year to $3.55 billion. Selling, administrative and general expenses fell 5.4% to $1.19 billion from the prior-year period.

Total operating profit (including financial services) was down 26% year over year to $2.31 billion in the fiscal second quarter.

The Production & Precision Agriculture segment’s sales fell 21% year over year to $5.23 billion due to lower shipment volumes, partially offset by price realization. The figure beat our model’s estimated revenues of $4.61 billion for the quarter. Operating profit decreased 30% year over year to $1.15 billion. Our estimate for the segment’s operating profit was $619 million.

Small Agriculture & Turf sales fell 6% to $2.99 billion from the year-earlier quarter. Our projection for the segment’s sales was $2.78 billion. Segmental sales were impacted by lower shipment volume, partially negated by price realization. Operating profit rose 1% year over year to $574 million. The figure beat our estimate for operating profit of $485 million for the segment.

Construction & Forestry sales were $2.95 million, down 23% year over year. The figure missed our projection of $3.29 billion. Operating profit decreased 43% year over year to $379 million. The downside was driven by lower shipment volumes and unfavorable price realization. Our estimate for the segment’s operating profit was $588 million.

Revenues in Deere’s Financial Services division were $1.38 billion in the reported quarter, down 1% year over year. The figure missed our estimate of $1.48 billion. Net income of the company’s Financial Services division was $161 million in the reported quarter compared with $162 million in the prior-year quarter.

DE reported cash and cash equivalents of $7.99 billion at the end of second-quarter fiscal 2025 compared with $7.32 billion at the end of fiscal 2024. The cash flow from operating activities was $568 million in the first half of fiscal 2025 compared with $944 million in the prior-year period. At the end of the quarter, the long-term borrowing was nearly $43 billion compared with $41 billion at the year-ago quarter’s end.

Deere expects net income for fiscal 2025 between $4.75 billion and $5.50 billion.

Net sales for Production & Precision Agriculture are expected to decrease 15-20% year over year in fiscal 2025.

Sales of Small Agriculture & Turf are expected to decline 10-15%. Sales of Construction & Forestry are projected to be down 10-15%. The Financial Services segment’s net income is expected to be $750 million.

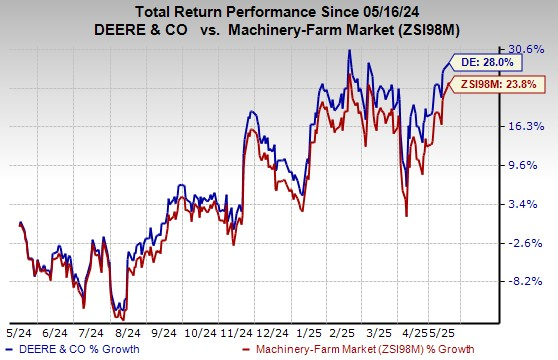

The company’s shares have gained 28% in the past year compared with the industry’s 23.8% growth.

Image Source: Zacks Investment Research

Deere currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AGCO Corp. AGCO delivered adjusted earnings per share of 41 cents in first-quarter 2025 compared with the prior-year quarter’s $2.32. The reported figure topped the Zacks Consensus Estimate of 3 cents.

AGCO’s net sales decreased 30% year over year to $2.05 billion in the March-end quarter. The top line beat the Zacks Consensus Estimate of $2.02 billion. Excluding the unfavorable currency-translation impacts of 2.4%, net sales fell 27.6% year over year.

Lindsay Corporation LNN posted earnings per share of $2.44 in second-quarter fiscal 2025 (ended Feb. 28, 2025), beating the Zacks Consensus Estimate of $1.89. The bottom line rose 49% year over year.

Lindsay generated sales of $187 million, up from $152 million in the year-ago quarter. The top line beat the Zacks Consensus Estimate of $180 million.

CNH Industrial N.V. CNH reported first-quarter 2025 adjusted earnings per share of 10 cents, which declined from 33 cents in the prior-year quarter. The figure, however, surpassed the Zacks Consensus Estimate of 9 cents.

In the first quarter, CNH Industrial’s net sales declined nearly 21% from the year-ago level to $3.82 billion but topped the Zacks Consensus Estimate of $3.79 billion. The company’s net sales from industrial activities came in at $3.17 billion, down 23% due to lower shipment volumes.

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

CNH Industrial N.V. (CNH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.