Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Celanese Corporation CE reported second-quarter 2025 earnings from continuing operations of $1.90 per share, which increased from $1.42 in the prior-year quarter.

Adjusted earnings were $1.44 per share, down 39.5% from $2.38 reported a year ago. The bottom line beat the Zacks Consensus Estimate of $1.38.

Revenues of $2,532 million decreased roughly 4.5% year over year. It beat the Zacks Consensus Estimate of $2,496.5 million. The decline in net sales was a result of a decrease in pricing and volumes. Prices fell 4% year over year in the quarter.

Net sales in the Engineered Materials unit were $1,442 million in the reported quarter, down around 1.7% year over year. It beat our estimate of $1,368.7 million. The segment reported an operating profit of $165 million and an adjusted EBIT of $214 million for the second quarter.

The Acetyl Chain segment posted net sales of $1,115 million, down roughly 7.2% year over year. It beat our estimate of $1,102.2 million. The segment generated an operating profit of $154 million and an adjusted EBIT of $196 million in the second quarter.

Celanese ended the quarter with cash and cash equivalents of $1,173 million, up roughly 23.3% sequentially. Long-term debt was up 2.5% sequentially to $12,689 million.

Cash provided by operating activities was $410 million and free cash flow was $311 million in the reported quarter.

Celanese projects a softer demand environment across most key end-markets for the second half of the year. The company expects that slowing demand will partly offset the benefits of its cost reduction initiatives, which are anticipated to be realized in the third quarter. Earnings are also expected to face an approximate $25 million sequential negative impact due to ongoing inventory reduction efforts. In response to the uncertain low-demand conditions, Celanese remains focused on maximizing cash flow and maintaining operational agility to align operations with available demand. For the third quarter, the company forecasts adjusted earnings per share in the range of $1.10 to $1.40 and reaffirms its expectation to generate $700 million to $800 million in free cash flow for 2025.

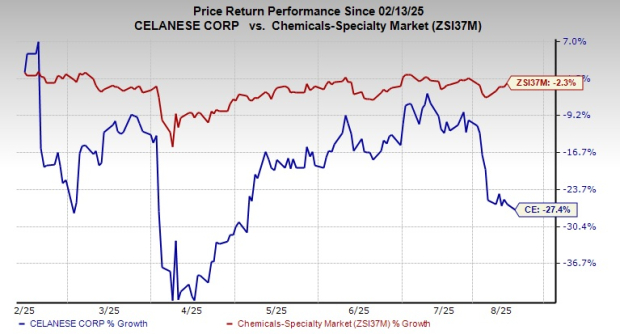

Celanese’s shares have lost 27.4% in the past six months compared with a 2.3% decline of the industry.

Image Source: Zacks Investment Research

CE currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth a look in the basic materials space are Avino Silver & Gold Mines Ltd. ASM, Gold Fields Limited GFI and Vizsla Silver Corp. VZLA.

Avino Silver is slated to report second-quarter results on Aug. 13. The Zacks Consensus Estimate for earnings is pegged at 3 cents per share. ASM’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average surprise being 104.2%. Avino Silver flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gold Fields is slated to report second-quarter results on Aug. 22. The Zacks Consensus Estimate for GFI’s second-quarter earnings is pegged at 59 cents per share. Gold Fields currently sports a Zacks Rank #1.

Vizsla is expected to report quarterly results on Sept. 11. The consensus estimate for VZLA’s earnings is pegged at a loss of a penny per share. VZLA’s earnings met the Zacks Consensus Estimate in three of the last four quarters while beating it in one, with the average surprise being 75%. Vizsla sports a Zacks Rank #1 at present.

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.