USD to NOK Forecast

If you opt for trading major currencies, especially European ones, the Norwegian Krone should be in your portfolio. USD/NOK is considered to be a great option for both intraday and long-term trading, even though it is not prone to significant fluctuations. Wonder what the USD/NOK rate will be in the coming days, weeks, or even years? This article provides an extensive review of both short-term and long-term USD to NOK forecast/prediction.

Table of Contents

USD to NOK Currency Rate Forecast Summary

USD/NOK Price History

USD to NOK Forecast for 2025

USD to NOK Forecast for 2026

USD to NOK Forecast for 2027

USD to NOK Forecast for 2028

USD to NOK Forecast for 2029

USD to NOK Forecast for 2030

What Affects the NOK Price?

USD/NOK Technical Analysis

How to Predict the Price of NOK

Conclusion: Is NOK a Good Investment?

FAQ

USD to NOK CURRENCY RATE FORECAST SUMMARY

Recent trends in forex markets show that the NOK exchange rate has been influenced by fluctuating oil prices, global interest rate changes, and shifts in investor sentiment.

Analysts expect NOK price movements to reflect Norway's strong economic ties to energy markets, alongside the Federal Reserve's monetary policy decisions in the US.

As of May 7, 2025, the USD to NOK exchange rate stands at approximately 10.27. USD to NOK forecasts suggest that the currency pair will be traded at approximately the same level throughout 2025 with a potential slight increase to around 10.925 by the end of the year.

Long-term market analysis points to an overall bullish trend. Projections anticipate a rise, reaching 13.718 in the first half of 2030. Investors should monitor economic indicators influencing the USD to NOK exchange rate.

Key Forecasts:

| Period |

USD to NOK Forecast |

| End of 2025 | 10.925 |

| 5-year outlook | 13.718 |

USD/NOK Price History

In 2024, the USD to NOK exchange rate experienced notable volatility. The year began at 10.5042 NOK per USD in January, steadily rising to a peak of 11.3657 in December.

| Date |

Price |

| Jan 01, 2024 | 10.5042 |

| Feb 01, 2024 | 10.6024 |

| Mar 01, 2024 | 10.8158 |

| Apr 01, 2024 | 11.1033 |

| May 01, 2024 | 10.4669 |

| Jun 01, 2024 | 10.6642 |

| Jul 01, 2024 | 10.8894 |

| Aug 01, 2024 | 10.5944 |

| Sep 01, 2024 | 10.5442 |

| Oct 01, 2024 | 10.9922 |

| Nov 01, 2024 | 11.0181 |

| Dec 01, 2024 | 11.3657 |

USD to NOK Forecast for 2025

The USD to NOK forecast in 2025 indicates a predominantly upward trend, despite minor fluctuations. Starting from June at 10.479, the rate is expected to progressively increase, reaching 10.925 by December - a cumulative rise of approximately 4.3%.

Monthly Forecast for 2025:

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| August 2025 | 10.519 | 10.557 | 0.36 % ▲ |

| September 2025 | 10.559 | 10.660 | 0.95 % ▲ |

| October 2025 | 10.661 | 10.794 | 1.23 % ▲ |

| November 2025 | 10.799 | 10.895 | 0.88 % ▲ |

| December 2025 | 10.898 | 10.925 | 0.22 % ▲ |

USD to NOK Forecast for 2026

The USD NOK forecast for 2026 indicates consistent appreciation of the USD, with the exchange rate rising steadily from January’s minimum of 10.917 NOK to December’s peak of 11.587 NOK. Monthly percentage changes suggest a mostly upward trajectory, reflecting stable leverage opportunities. Investors should closely monitor monthly fluctuations of USD to NOK forecast, leveraging the consistent krone forecast of gradual weakening throughout this time period.

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| January 2026 | 10.917 | 10.925 | 0.03 % ▲ |

| February 2026 | 10.925 | 10.952 | 0.25 % ▲ |

| March 2026 | 10.954 | 11.028 | 0.62 % ▲ |

| April 2026 | 10.994 | 11.049 | 0.27 % ▲ |

| May 2026 | 11.056 | 11.154 | 0.81 % ▲ |

| June 2026 | 11.141 | 11.229 | 0.74 % ▲ |

| July 2026 | 11.180 | 11.242 | -0.44 % ▼ |

| August 2026 | 11.181 | 11.220 | 0.34 % ▲ |

| September 2026 | 11.221 | 11.320 | 0.88 % ▲ |

| October 2026 | 11.323 | 11.454 | 1.14 % ▲ |

| November 2026 | 11.459 | 11.557 | 0.85 % ▲ |

| December 2026 | 11.560 | 11.587 | 0.22 % ▲ |

USD to NOK Forecast for 2027

The USD to NOK forecast for 2027 indicates the exchange rate will trend consistently upward, reaching a high-end rate of 12.249 NOK by December. Despite minor fluctuations mid-year, overall momentum is positive, with steady incremental increases each month.

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| January 2027 | 11.579 | 11.586 | 0.01 % ▲ |

| February 2027 | 11.588 | 11.613 | 0.22 % ▲ |

| March 2027 | 11.617 | 11.690 | 0.58 % ▲ |

| April 2027 | 11.656 | 11.710 | 0.24 % ▲ |

| May 2027 | 11.717 | 11.816 | 0.79 % ▲ |

| June 2027 | 11.803 | 11.889 | 0.68 % ▲ |

| July 2027 | 11.843 | 11.904 | -0.42 % ▼ |

| August 2027 | 11.843 | 11.881 | 0.33 % ▲ |

| September 2027 | 11.881 | 11.982 | 0.85 % ▲ |

| October 2027 | 11.986 | 12.114 | 1.06 % ▲ |

| November 2027 | 12.121 | 12.219 | 0.8 % ▲ |

| December 2027 | 12.219 | 12.249 | 0.23 % ▲ |

USD to NOK Forecast for 2028

The USD to NOK forecast for 2028 highlights continued strength in the USD, reaching a maximum of 12.911 NOK by December. The krone forecast suggests ongoing depreciation, reinforcing the trend from current USD levels.

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| January 2028 | 12.241 | 12.249 | 0.01 % ▲ |

| February 2028 | 12.249 | 12.278 | 0.23 % ▲ |

| March 2028 | 12.279 | 12.353 | 0.54 % ▲ |

| April 2028 | 12.319 | 12.377 | 0.26 % ▲ |

| May 2028 | 12.384 | 12.478 | 0.68 % ▲ |

| June 2028 | 12.464 | 12.555 | 0.69 % ▲ |

| July 2028 | 12.505 | 12.566 | -0.42 % ▼ |

| August 2028 | 12.505 | 12.543 | 0.3 % ▲ |

| September 2028 | 12.546 | 12.647 | 0.8 % ▲ |

| October 2028 | 12.649 | 12.781 | 1.03 % ▲ |

| November 2028 | 12.785 | 12.882 | 0.75 % ▲ |

| December 2028 | 12.885 | 12.911 | 0.19 % ▲ |

USD to NOK Forecast for 2029

The USD to NOK forecast for 2029 indicates ongoing appreciation of the dollar, climbing consistently above today's range, with the exchange rate projected to reach a high of 13.573 NOK by December. The krone forecast continues to show steady depreciation from the current rate.

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| January 2029 | 12.903 | 12.911 | 0 % ▲ |

| February 2029 | 12.911 | 12.938 | 0.2 % ▲ |

| March 2029 | 12.941 | 13.015 | 0.52 % ▲ |

| April 2029 | 12.981 | 13.038 | 0.24 % ▲ |

| May 2029 | 13.044 | 13.140 | 0.67 % ▲ |

| June 2029 | 13.126 | 13.216 | 0.64 % ▲ |

| July 2029 | 13.167 | 13.228 | -0.39 % ▼ |

| August 2029 | 13.166 | 13.206 | 0.3 % ▲ |

| September 2029 | 13.207 | 13.308 | 0.76 % ▲ |

| October 2029 | 13.311 | 13.440 | 0.96 % ▲ |

| November 2029 | 13.447 | 13.544 | 0.72 % ▲ |

| December 2029 | 13.546 | 13.573 | 0.19 % ▲ |

USD to NOK Forecast for 2030

The USD to NOK forecast for early 2030 shows minimal upward movement, positioning the exchange rate between 13.565 and 13.718 NOK by May. Although the rate remains stable, investors should remain cautious as it concerns long-term forecast.

| Month |

Minimum Rate |

Maximum Rate |

Percentage Change |

| January 2030 | 13.565 | 13.572 | 0.01 % ▲ |

| February 2030 | 13.574 | 13.600 | 0.19 % ▲ |

| March 2030 | 13.603 | 13.677 | 0.49 % ▲ |

| April 2030 | 13.643 | 13.698 | 0.21 % ▲ |

| May 2030 | 13.703 | 13.718 | 0.11 % ▲ |

CoinCodex comes with slightly more negative predictions for 2030.

| Month |

Min. Price |

Max. Price |

Potential ROI |

| Jan 2030 | 9.57 | 9.95 | 3.91% |

| Feb 2030 | 9.59 | 9.92 | 4.17% |

| Mar 2030 | 9.62 | 10.01 | 3.35% |

| Apr 2030 | 9.65 | 9.89 | 4.54% |

| May 2030 | 9.83 | 10.01 | 3.34% |

| Jun 2030 | 9.65 | 9.96 | 3.80% |

| Jul 2030 | 9.71 | 10.10 | 2.44% |

| Aug 2030 | 10.10 | 10.38 | 0.18% |

| Sep 2030 | 10.16 | 10.40 | 0.45% |

| Oct 2030 | 10.33 | 10.54 | 1.73% |

| Nov 2030 | 10.34 | 10.49 | 1.28% |

| Dec 2030 | 9.99 | 10.49 | 1.26% |

What Affects the NOK Price?

As the world's reserve currency, the US dollar serves as both a predictor of the international economy and a sanctuary for investors in volatile times. As investors strove to safeguard their capital from the uncertainties posed by the Russia-Ukraine war and the possibility of a worldwide recession, USD’s value spiked in 2022. An aggressive boost of the US interest rates to combat excessive inflation has also helped the currency.

Among the G10 currencies—the top ten most liquid and actively traded currencies on the foreign exchange markets—is the Norwegian Kroner. The Group of Ten (G10) countries that supply funding to the International Monetary Fund are no longer represented by the G10 currencies.

After Qatar and Russia, Norway is the world's third-largest supplier of natural gas. It also exports a sizable amount of oil. As a result, changes in the price of oil have an impact on the NOK price.

The US and Norwegian interest rates have an impact on the value of the Kroner as well. A currency with higher interest rates tends to attract investors seeking better returns on their investments with predictable payouts.

USD/NOK Technical Analysis

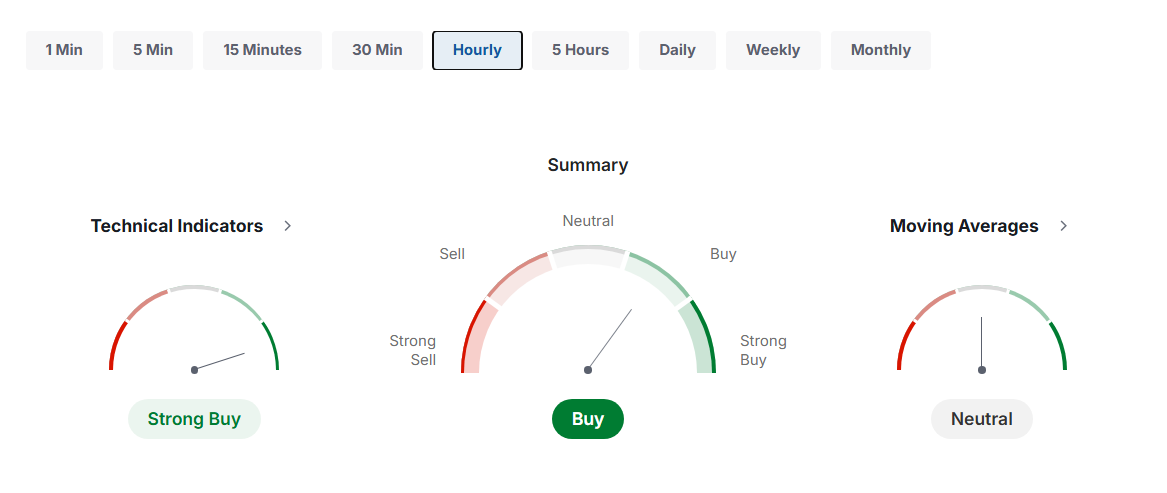

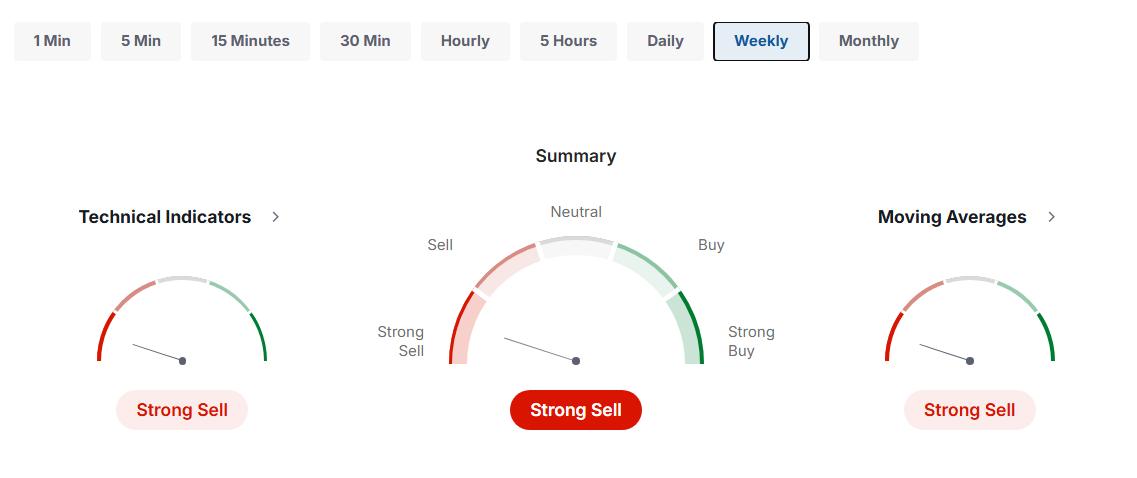

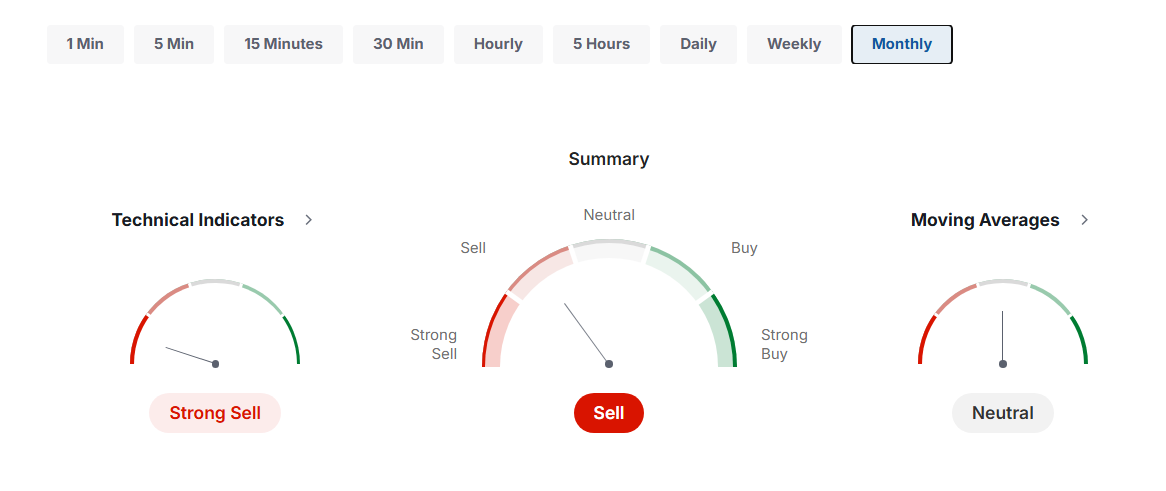

Technical analysis for the USDNOK exchange rate currently signals mixed trends. Hourly charts remain bullish, showing strong buy signals.

However, weekly and monthly charts show bearish signals, indicating possible downward pressure ahead. Investors should closely monitor critical support levels near 10.358 and resistance at 10.400.

How to Predict the Price of NOK

To create a USD to NOK forecast, take into account the following aspects:

- Keep an eye on macroeconomic indicators (GDP, inflation percent, unemployment stats, and interest rates) in Norway.

- Track the monetary policy of Norges Bank, the central bank of Norway, and how it changes the interest rates.

- Norway is a major oil exporter, and therefore, asset prices can significantly impact the Norwegian economy and the Krone’s value.

- Political stability in Norway defines investors’ confidence and, consequently, the value of the Norwegian currency.

- Analyze price charts and technical indicators (moving averages, support and resistance levels, and more complex instruments) to identify patterns and trends in NOK price movements.

- Pay attention to market sentiment and investor behavior towards the Norwegian Krone.

- Consider the broader global economic state, including trade tensions, currency movements, and economic data releases from major economies.

- Understand the correlation between NOK and other assets, such as commodities, currencies, and equities.

- Analyzing historical data for seasonal trends in NOK's price movements will provide you with additional insights for prediction.

Conclusion: Is NOK a Good Investment?

Overall, the USD to NOK forecast suggests steady appreciation of the USD against the Norwegian Krone, projecting rates around 10.925 by the end of 2025 and rising above 13.7 by mid-2030. Historical volatility highlights NOK’s sensitivity to oil prices, global markets, and US monetary policy. The Norwegian krone (NOK) offers opportunities for investors trading on the forex market but comes with notable risks. Therefore, monitor oil prices, Norway’s economic performance, and global monetary policies before committing significant capital to forex pairs involving NOK.

FAQ

Is it profitable to invest in the USD/NOK forex pair?

Investing in the USD/NOK forex pair can be profitable for short-term traders capitalizing on NOK price movements and oil market trends, but long-term investments carry higher risks due to market volatility and geopolitical uncertainties.

Why has USD/NOK been dropping?

USD to NOK forecast was negative with the pair dropping primarily due to rising oil prices, improved investor sentiment toward the Krone, and shifts in expectations regarding US and Norwegian interest rates.

What will the USD/NOK FX rate be worth in five years (2030)?

In 2030, the USD to NOK forecast is to reach approximately 13.718, indicating sustained appreciation of USD driven by long-term market trends and Norway’s economic ties to energy markets.

Is USD/NOK a Buy, Sell or Hold?

SD to NOK forecast currently signals a mixed outlook; short-term indicators suggest bullish momentum, while longer-term charts show bearish signals. Investors should carefully monitor support and resistance levels, maintaining a cautious, neutral stance at this time.

When is the best time to trade USD/NOK?

The best time to trade USD/NOK is during peak market liquidity, typically during overlapping European and U.S. trading hours, when volatility and volume increase, providing clearer price action for traders.